The fresh Government Construction Funds Institution (FHFA) is a beneficial U.S. government institution developed by the fresh new Casing and Economic Recuperation Work from 2008 (HERA). Their chief part should be to offer supervision away from mortgage and you can property credit bodies-backed organizations (GSEs), particularly the new Federal national mortgage association (Federal national mortgage association), Federal Mortgage Home loan Firm (Freddie Mac computer), and Federal Home loan Bank operating system.

Tips

- The FHFA is actually faced with ensuring that their managed organizations perform soundly to greatly help care for exchangeability regarding the home loan markets.

- Pursuing the facilities of one’s FHFA, Fannie mae and you can Freddie Mac was in fact added to conservatorship towards goal of coming back these to solvency.

- A portion of the FHFA’s funds would go to enabling reasonable-income group get affordable property.

When try the latest FHFA created and why?

The latest Government Houses Financing Institution was created in 2008 on the wake of your 200708 economic crisis. Especially, it absolutely was designed to target default-relevant monetary filters within Federal national mortgage association and you can Freddie Mac computer-and this, as regulators-backed people (GSEs), was publicly held enterprises, but with a beneficial tacit authorities support. In the event that a couple of GSEs necessary a beneficial bailout to stay afloat (and therefore critics contended try owed at the least to some extent so you’re able to lax financing standards), policymakers figured the best advice might possibly be increased supervision thanks to a special company.

Regardless if one another GSEs are officially belonging to investors, at the time of 2024, both are nevertheless beneath the conservatorship of the FHFA. Fannie mae shares change into the U.S. transfers in ticker symbol FNMA; Freddie Mac shares are still in the delisted reputation.

Including Fannie mae and you will Freddie Mac computer, this new FHFA is also accountable for brand new 11 Federal Mortgage Financial institutions (FHLBanks) and you may Office regarding Loans. Of the managing these organizations, the newest FHFA tries to make https://paydayloanalabama.com/carlisle-rockledge/ sure the housing funds sector stays stable and will are employed in individuals fiscal conditions. The latest FHFA is responsible for managing more $8 trillion inside home loan funding along the All of us.

FHFA takeover off Fannie mae and Freddie Mac computer

Fannie and you may Freddie was assigned of the authorities to assist manage exchangeability regarding the mortgage market. They do this mainly by buying mortgage loans to your second markets, packing a lot of them on mortgage-backed securities (MBS)-generally swimming pools away from mortgage loans-and you can attempting to sell these to dealers. Home loan securitization frees up lenders and also make a great deal more mortgage brokers once the they can offload the danger to the people willing to sustain it.

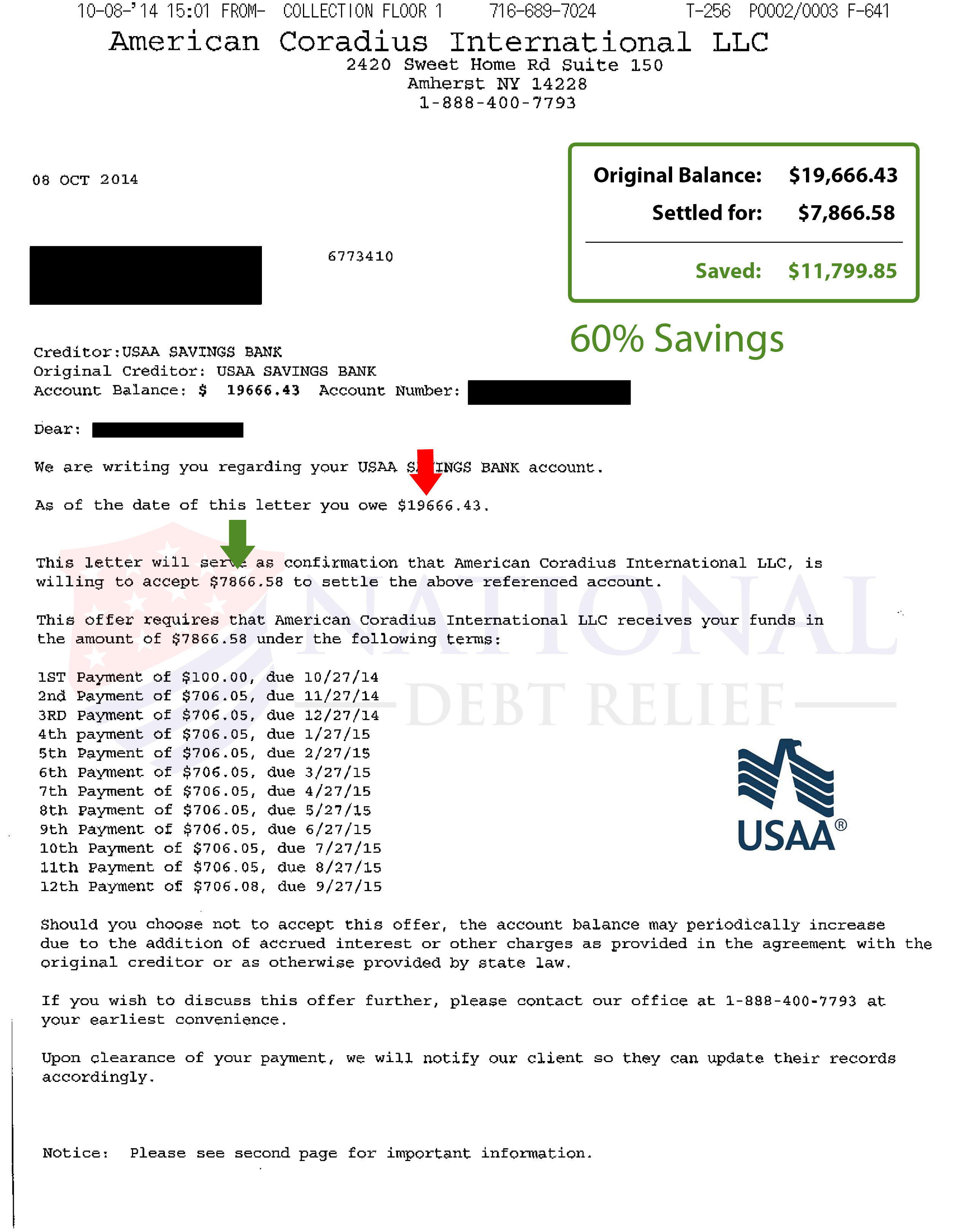

Immediately following it was established, the brand new FHFA placed Fannie and Freddie toward conservatorship. The 2 GSEs was to the brink away from failure as the defaults on the 2007 financial recession become pulling on the balance sheets. The new freshly mainly based FHFA set-up for pretty much $two hundred million in the bailout funds from the latest You.S. Treasury.

At exactly the same time, the fresh FHFA changed the fresh new forums out-of administrators to have Fannie and Freddie and you can first started using this new rules made to remove operational chance. Over time, both GSEs paid its fund. Because of the 2019, it first started preserving the earnings and you can doing capital supplies. While they can now work with a little a great deal more freedom, Fannie and you may Freddie will still be under conservatorship at the time of 2024.

Key characteristics of one’s FHFA

To maintain liquidity regarding the property loans sector, the newest FHFA is designed to make sure bodies-sponsored organizations is solvent. Here are a few of the ways the new FHFA fulfills the mission:

- Evaluate for every single FHLBank per year so that surgery was sound and you can the banks are solvent.

- Screen financial obligation provided from Workplace out-of Finance.

- Frequently remark the newest surgery away from Federal national mortgage association and you may Freddie Mac so you can be certain that it will always be solvent and you can sound.

- Maintain conservatorship more Fannie and you may Freddie as well as their property.

- Tune economic industry manner and you can suggest modifications and you may programmes from action in order to regulated organizations.

- Recommend rule ratings while making guidelines regarding the fees and you can practices lay in place from the GSEs and you can FHLBanks.

How ‘s the FHFA financed?

The latest Government Housing Financing Service will not discover its finances regarding Congress. Alternatively, funding arises from regulated organizations (just like the means the latest FDIC try funded from the representative finance companies). Fundamentally, Fannie, Freddie, while the FHLBanks capture a portion of the budgets and rehearse those funds to fund the fresh new FHFA.

This new FHFA are a different department

It is essential to keep in mind that the Federal Property Financing Agency is separate regarding Government Casing Administration (FHA). The two vary organizations and you can located its financial support regarding more supply.

A portion of the funds goes toward permitting lower-earnings families obtain sensible construction through the national Houses Believe Money. The capital Magnet Loans aids in neighborhood advancement programs. The brand new FHFA support manage these types of financing and you will encourages the latest GSEs’ benefits these types of attempts. When you look at the 2024, Fannie and you can Freddie provided $301 million earmarked for those a couple of funds.

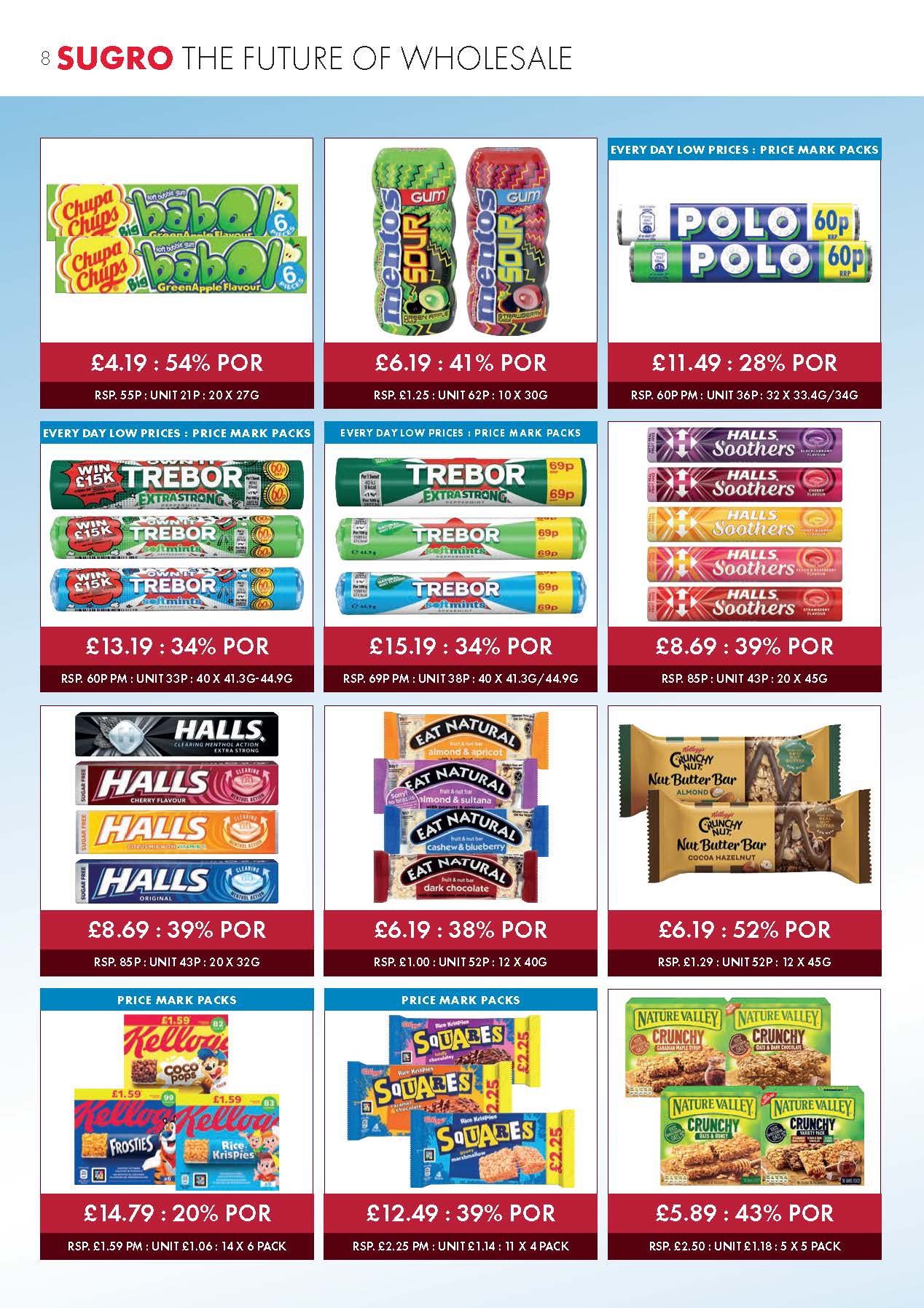

One of the ways the federal government decreases the exposure when issuing otherwise delivering more than mortgages is through billing loan-peak price changes (LLPAs). Such charge, which happen to be built-up on the what’s known as LLPA Matrix, are based on next things:

In 2023, this new FHFA advised the new fees based on DTI. Home loan globe leaders reported the fresh new timeline is unworkable additionally the charges would impose an unrealistic burden for the consumers, therefore the signal are rescinded by the FHFA.

An alternate controversy from inside the 2023 stemmed out of a rumor one to the latest laws create trigger individuals with highest credit ratings expenses so much more inside the charge than those having all the way down credit scores. This is refuted because of the FHFA director Sandra L. Thompson.

Fundamentally, the newest FHFA refurbished their rules and you can took input into account before introducing the latest LLPA matrix to possess 2024.

The conclusion

The fresh Government Housing Money Company is made to give an additional number of supervision which had been identified become missing leading right up to the mortgage crisis regarding 200708. From the regulating and evaluating the soundness away from Federal national mortgage association, Freddie Mac, while the Government Financial Financial institutions, the latest FHFA are tasked having ensuring that the loan field remains h2o which government entities must not need resort to a unique substantial bailout down the road.