Our staff of blockchain developers works to produce you with one of the best providers so you might begin your individual DeFi Yield Farming platform. It requires a combination of strategic decision-making, risk administration, and the utilization of revolutionary DeFi instruments and protocols. Diversify your yield farming investments throughout multiple platforms and protocols. This approach may help mitigate the impression of impermanent loss and smart contract vulnerabilities in your total portfolio. The worth of the tokens deposited into a liquidity pool can fluctuate due to market circumstances. Price volatility can impression the overall yield and probably result in a decrease worth of assets in comparability with the preliminary funding.

By conducting thorough research, diversifying investments, and staying informed, participants can doubtlessly mitigate risks and capitalise on the rewards provided by yield farming. As the DeFi ecosystem continues to evolve, yield farming will doubtless remain a dynamic and thrilling side of decentralised finance, attracting each experienced and novice traders. We get from our purchasers these kind of questions that how doe yield farming works. The investor buys the cryptocurrency or digital asset in a standard crypto investment in question for a selected amount of money and prays that the price goes as much as generate a profit. Investors lend the crypto tokens or coins, as a substitute of purchasing for more cryptocurrencies that they by now have for a chance to earn a more revenue as the interest from its growth.

The annual price of return, abbreviated as APR, is a percentage-based yearly rate of return. This annual proportion fee (APR), often generally known as easy curiosity, provides DeFi users with a determine that they could examine to different protocols’ rates. Explore numerous Cryptex options, compare the pricing plans, and unlock the potential of seamless operations by choosing the proper software for your business. Explore various BarnBridge options, evaluate the pricing plans, and unlock the potential of seamless operations by deciding on the proper software for your business. Explore numerous ReHold features, examine the pricing plans, and unlock the potential of seamless operations by deciding on the right software program for your business. There are several reasons why businesses need DeFi staking platforms.

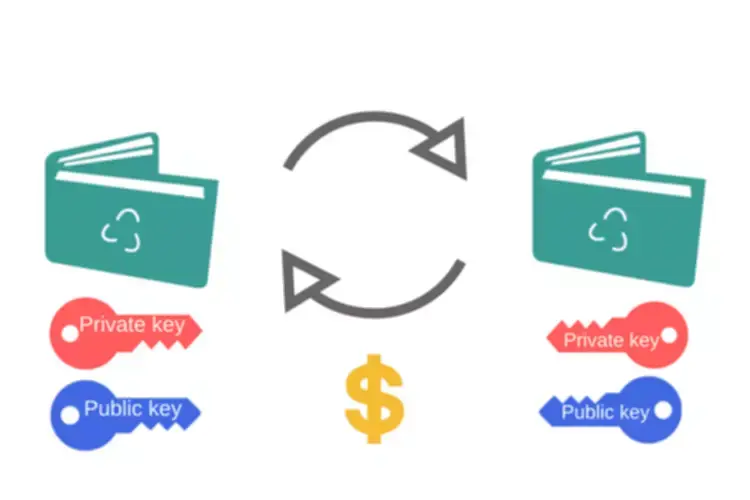

In a matter of minutes with preset circumstances being met the flawless onboarding process happens. Capital effectivity in decentralized finance (DeFi) refers back to the capability to maximise the utilization and productiveness of capital within a decentralized monetary ecosystem. It entails optimizing the deployment of belongings to generate the very best possible returns while minimizing inefficiencies, costs, and idle capital. Liquidity suppliers earn a share of the fees generated from trades facilitated by the liquidity pool.

Is Yield Farming Profitable?

Traders across the globe flock in to swap their property using the liquidity swimming pools created by people like us. Liquidity providers are incentivized within the type of UNI tokens for offering liquidity. They can even stake these UNI tokens in the protocol to earn additional yield. Uniswap is a decentralized change (DEX) that allows no-trust token exchanges. To build a market, liquidity providers make investments an average of two tokens. Liquidity providers receive fees from trades that take place of their pool in trade for providing liquidity.

- Aave is a borrowing and lending platform that enables lenders to park their crypto to earn a yield.

- In the decentralized finance (DeFi) business, one of the newest and hottest subjects is Yield farming.

- Keep your self updated with the most recent developments in the DeFi house.

- DeFi permits customers to farm completely different crypto tokens on various blockchain platforms.

- Enabling customers to deposit and withdraw funds securely is crucial for person engagement and satisfaction.

- The extra people who purchase tokens, the extra sway they may have over how the new system functions.

DeFi allows customers to farm totally different crypto tokens on numerous blockchain platforms. DeFi platforms use algorithms to regulate costs during events, like when the loss is smaller than the profit. This characteristic permits it to create extra liquidity than different traditional financial platforms. Yield farming is among the most lucrative, extremely profitable, types of crypto investment with a excessive liquidity.

What Is Defi Yield Farming?

Decentralised Finance (DeFi) has taken the financial world by storm, revolutionising conventional banking and funding models. Within the expansive world of DeFi, yield farming has emerged as a well-liked means for investors to maximise their returns. In this article, we are going to look into the world of yield farming, inspecting what it’s, the method it works, the dangers concerned, and the potential rewards it presents to participants.

Oh, did I point out that each one of this elaborate tango is triggered and not utilizing a centralized authority controlling it? Thanks to the good contracts that self-execute when certain situations are met. These smart contracts are immutable as they’re built on blockchain. It is commonly said that if blockchain had been a metropolis, then code (smart contracts) would be the legislation.

Many platforms keep accumulating your rewards and require you to collect them manually. Did you assume that you would merely decide the best yield-generating platform and move your crypto? You would possibly wish to understand the history of the protocol, team Yield Farming, audit reports, and reviews. For some purpose, fraudsters have a tendency to stay a step ahead of retail investors. DeFi yield farming is house to a few of the greatest scams on this house.

None of the world governments has managed to manage the decentralized finance area so far. [newline]Therefore, the onus of declaring the profits/losses lie within the palms of the taxpayer. In case of an inquiry, it might be tough to disclose your previous transactions and clarify them to the tax department. Overall, it’s not onerous to search out farms that supply a yield to the tune of 30%.

The Longer Term Is Coded: Diving Into The World Of Good Contract Development Providers

DeFi Yield Farming is the follow of staking or lending bitcoin within DeFi protocols to generate substantial returns in the form of curiosity, rewards, or extra cryptocurrency. The time period “farming” alludes to the large curiosity generated by the provision of assorted DeFi protocols’ liquidity. DeFi protocols additionally give out tokens, which stand for every user’s portion of the liquidity pool and could be transferred to different platforms to maximize gains along with prizes. These rewards come from the fees generated by the DeFi protocol, distributed among liquidity suppliers in proportion to the quantity of liquidity they’ve provided.

Decentralized finance (DeFi) permits for faster and cheaper settlements when in comparison with traditional finance. In addition, DeFi platforms permit companies to enhance their liquidity position. DeFi platforms will allow you to borrow funds towards your crypto property. DeFi staking platforms are constructed on high of decentralized finance (DeFi) protocols. These protocols allow you to borrow, lend, and commerce cryptocurrencies with out the need for a 3rd party.

Unveiling The Intricacies Of Nft Development Firm And Nft Market Development

This course of is just like yield farming, nevertheless it focuses on producing liquidity instead of profits. It permits you to transfer your assets out and in of DeFi platforms shortly and easily. This process is ideal for companies that need to keep their funds liquid. Additionally, this course of is ideal for companies that are on the lookout for a way to get into DeFi with out the need for collateral.

DeFi protocols can change their rules, tokenomics, or stop providing rewards altogether. This uncertainty can significantly have an result on the anticipated returns and the viability of the yield farming technique. The quantity of liquidity can change fast as users provide liquidity and pull their crypto tokens from the pool.

Defi Yield Finance Platforms And Protocols

The DeFi sector is very adaptive and compatible. Several DeFi platforms stake bitcoin and transmit it instantly from platform to platform to extend investment outcomes. Programmability

In the digital tapestry, a visionary NFT growth firm is a digital alchemist, innovation the place tech, creativity, and blockchain converge. It will make certain that you obtain the help https://www.xcritical.in/ and help you want if you want it. The DeFi staking platform should seamlessly integrate with your existing infrastructure.

By design, the early adopters get high returns, and as these returns attract more people, returns diminish. Later, you can pay the principal and interest and get again your (hopefully) appreciated crypto. The DeFi staking platform should have an interactive interface that is easy to use. It will permit you to handle your belongings and transactions on the platform easily. Some criminals can steal your funds through pretend yield farms and other crypto scams much like these in different components of the crypto ecosystem. You would possibly lose all your cash when you plan to jump in with out understanding these risks.

If you assume that we’re spreading paranoia, here’s a web site that tracks frauds and scams in this domain. Since the yields have a tendency to vary in a very brief period, it typically requires vigilance and time for farmers to cull out the very best strategies. However, for someone who can handle it, yield farming is extremely profitable even in 2023. In truth, it is the fifth largest protocol by total value locked ($5B) in it.