Refinancing settlement costs normally may include step three% so you can 6% of your own loan amount. For example, in the event the mortgage are $220,000, your closing cost shall be around $six,600 in order to $thirteen,200. It is a large contribution, thus ready your finances before taking an excellent refi.

Refinancing settlement costs are also influenced by mortgage circumstances. Pay attention to the adopting the home loan things and how capable affect their expenses:

Origination Situations: Speaking of initial costs you have to pay into the operating, study, and you can acceptance of the mortgage. Origination costs are essential by loan providers to pay for your loan manager. Speaking of considering a percentage of the amount borrowed, that’s usually around 0.5% to one%. Origination facts is actually flexible, therefore to talk to your lender to help reduce your refinancing costs.

Discount Affairs: You should buy disregard points from your own lender to lessen the interest rate on your own home loan. Thus, it decreases the complete notice costs of the financing. Paid off as the an initial payment, write off situations is very beneficial after you decide to remain enough time-term in a property. One to dismiss point is usually step 1% of the amount borrowed. For-instance, step 1 point on a good $250,000 mortgage are $2,five hundred. A half part is actually $1,250, and you may a-quarter part try $625.

Aside from the convenience of expertise, it will help you can get a better rate and you can title versus changing to a different financial

Disregard circumstances vary for each and every lender and are usually preferably reduced on closure. Though it should be rolled into the mortgage, it increases the loan amount. A top amount borrowed causes higher monthly installments. It is going to elevates offered to arrive a great breakeven section, which is the big date it needs recoup the cost of refinancing.

- Tax statements, W-2 and you may 1099

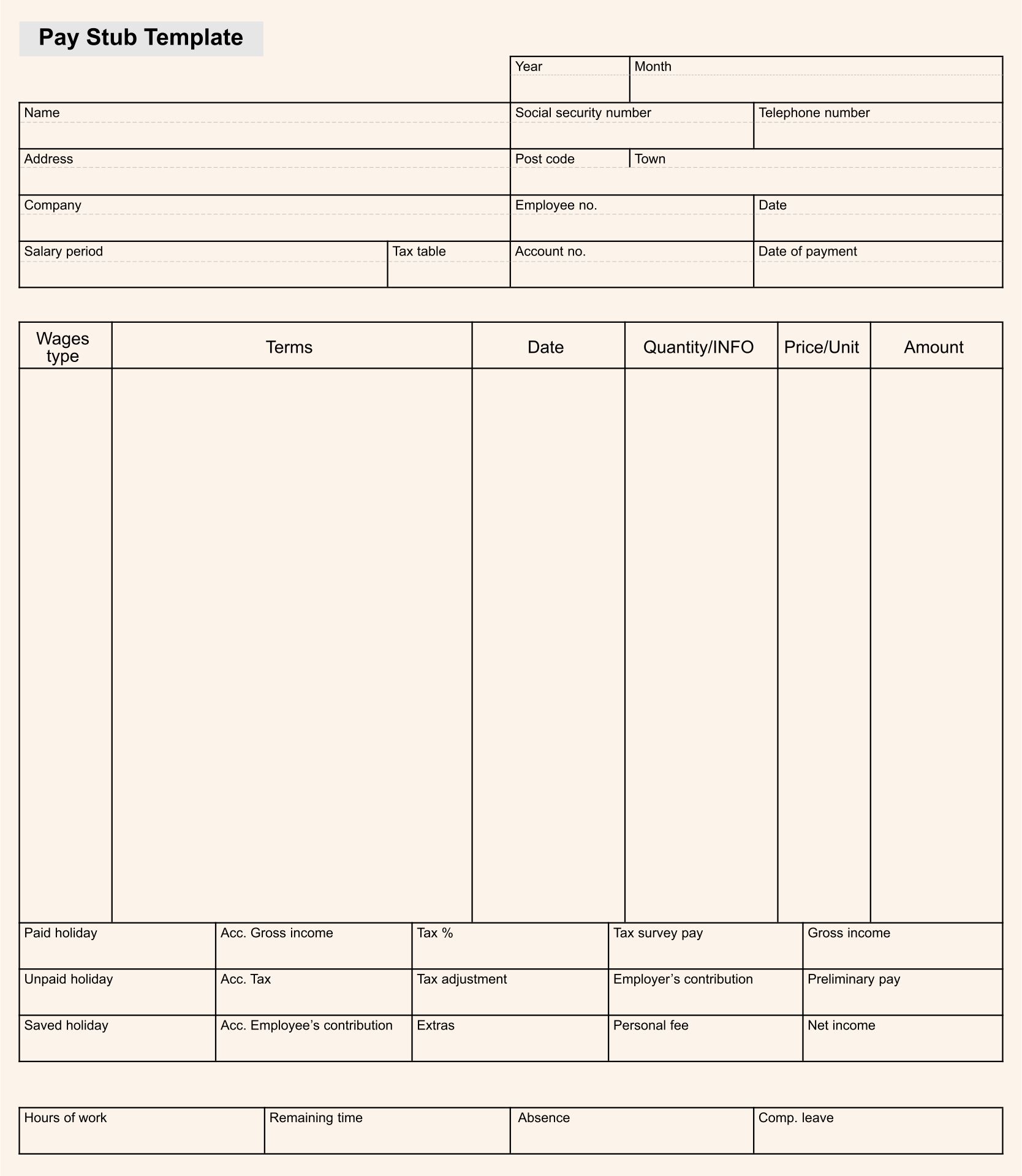

- Past thirty days out of pay stubs

- one year out of bank statements

- Current credit history

- Most recent household assessment

You can note that refis want similar documents as the buy home loans. Ergo, consider refinancing along with your brand-new mortgage lender.

The newest COVID-19 pandemic drove the worldwide benefit towards an economic downturn during the 2020. Fannie mae and you will Freddie Mac, and therefore sponsors around 70% of mortgage loans, forgotten a projected $six billion into the crisis. In response, it needed mortgage originators so you’re able to fees a bad markets re-finance percentage away from 50 basis things. The new laws commercially took effect set for all the consumers trying to get refinances. People exempted was individuals having balances all the way down otherwise equal to $125,000, along with FHA and you can Virtual assistant refinances. Pay attention to which more costs.

When Try Refinancing Helpful?

If at all possible, you ought to re-finance so you can safe a considerably lower price, at the least 1% to help you dos% below the brand spanking new price. This may dramatically lower your loan’s attention charges, and that saves tens of thousands of bucks over the life of the loan. It’s the good reason why more people tend to refinance when general refinancing increase, due to the fact Government Set-aside remaining benchmark cost close zero so you’re able to uphold market liquidity.

Additionally, its beneficial if you can refinance for the a decreased rates and you may faster title, particularly a beneficial 15-year fixed mortgage. Yet not, note that refinancing towards a shorter identity constantly contributes to higher monthly obligations. You need to gauge in the event the finances can afford it. And since refinancing entails high priced will cost you, its more desirable for those who propose to remain to have an excellent long-time in their home. In the event the possible circulate after a while, refinancing is not an useful alternative.

Simultaneously, find out about prepayment penalty ahead of refinancing. Altering in order to a beneficial rates try disadvantageous so you’re able to lenders, particularly into the first few years of the borrowed funds. It lose interest earnings they may deserve for folks who left your own brand new loan. So you’re able to deter very early refinancing, lenders implement prepayment punishment charge.