When it comes to a job alter, its crucial to recognize how which choice make a difference certain issues of your life, as well as your home loan travels. This can be particularly related for potential real estate buyers that happen to be throughout the process of, or provided, a job change.

Your own employment reputation and you can income balances are fundamental situations in this testing. Hence, changing jobs, which ways a change within the income and you can job balances, can impact your mortgage recognition techniques. This article aims to bring a thorough understanding of this commonly missed element, letting you browse your own home loan travel amidst a position changes a whole lot more effortlessly.

Expertise Mortgage loans

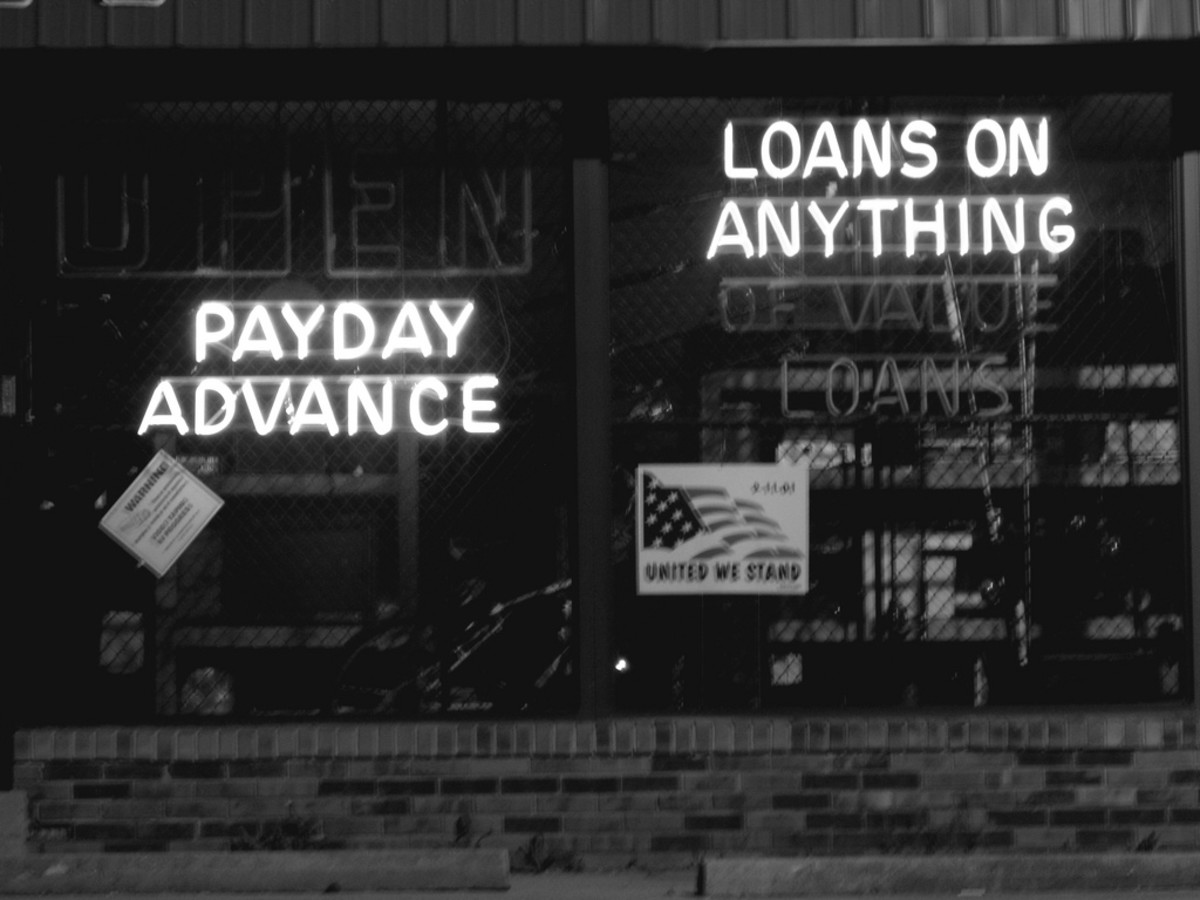

Home financing is basically that loan that you take-out so payday loans Delta you can buy possessions otherwise property. Its an extended-label partnership, will long-term 25 years or more, as well as your home is utilized as the equity. This means if you fail to match costs, the financial institution can also be repossess your residence to recuperate the borrowed funds.

A position balances takes on a vital role from the home loan procedure. Lenders you prefer promise that you have a stable earnings to meet up with their month-to-month mortgage repayments. They typically favor individuals have been with the same company for around a couple of years.

The significance of Secure A job

Secure employment offers lenders rely on on your own power to consistently generate your own home loan repayments. If you’re considering a career alter, it is very important know the way this may possibly apply to your own financial excursion. A job transform you will definitely indicate a time period of uncertainty or changing income, that could build lenders unwilling.

Yet not, work change cannot immediately disqualify you against bringing a mortgage. The primary is to try to know how lenders consider a career and income balances, also to package your career moves consequently.

New Feeling off Field Changes into the Financial Acceptance

Changing professions is notably perception your odds of delivering home financing acceptance. Lenders check jobs balances given that a critical factor in choosing their capability to pay-off the borrowed funds.

Earnings Balances

After you change careers, your revenue may fluctuate, particularly when you are moving away from an excellent salaried standing in order to care about-work otherwise a position with variable income. This imbalance makes loan providers hesitant since it introduces suspicion in the your capability to meet monthly premiums.

Work Records

Very lenders favor borrowers with no less than a couple of years away from constant a job in the same occupations. A recent profession change, such as to a different globe, is visible since the a threat, probably affecting your financial recognition.

Real-Existence Example

Thought John, exactly who recently switched regarding a steady jobs with it first off his own team. Even with a good credit score, the guy battled discover home financing acceptance as the loan providers seen their new clients because risky.

To summarize, employment change can impact your own mortgage approval process, but wisdom these affects makes it possible to plan most useful.

Factors Mortgage brokers Think

Mortgage lenders evaluate several situations whenever deciding to agree a mortgage application. Perhaps one of the most crucial was a job records and you will stability.

Work Records

Lenders like individuals having a steady a career records. Generally, they want to come across at least a couple of years from continued a job. Repeated occupations transform, specifically with assorted marketplaces, you’ll raise red flags.

Earnings Balances

Stable, foreseeable earnings offers loan providers trust on your capacity to see monthly mortgage payments. A job transform leading so you’re able to unpredictable otherwise erratic income can get complicate the financial recognition procedure.

Debt-to-Money Proportion

It proportion, usually abbreviated because DTI, is yet another important foundation. It tips their full month-to-month loans costs up against your own disgusting monthly earnings. A position changes inside your money you’ll feeling this proportion and you will your home loan candidates.