Point Selection

Done well on the decision to purchase a home. The procedure might be tiring and you will tiring, but it also is actually satisfying and satisfying particularly if you know how the price is accomplished. This informative guide is supposed first of all in the usa property market.

If you have chose to purchase, one thing to consider was, “What type of home would We wish to buy?” This is very important, as you should not purchase a property which is also short, otherwise too large. You might be able to afford a half dozen-bed room house, but you might not you would like a half dozen-room house. When you’re a single individual would you like all that place? Perform a beneficial condo feel a far greater get? Think about whenever you are hitched? Now you is actually one or two. Exactly what if you are going having youngsters? If you find yourself which is an event that could not have occurred, otherwise might not occur, how can you plan for that?

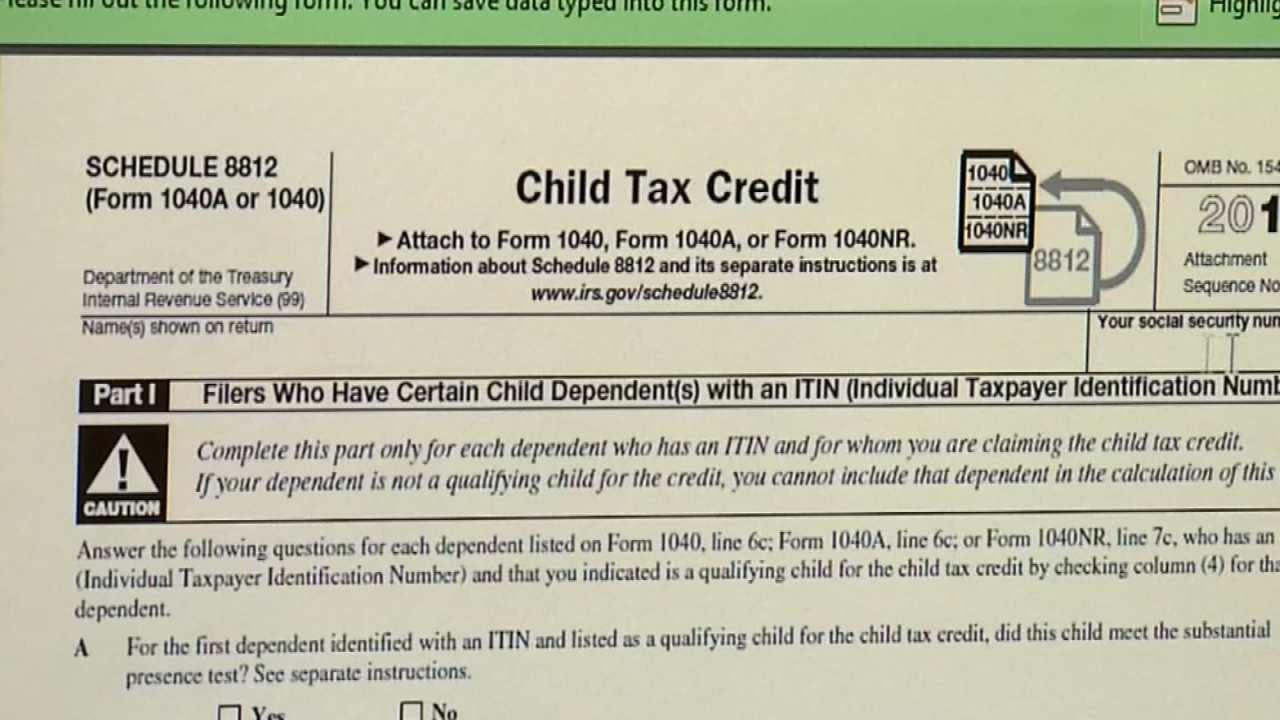

Delivering a mortgage

Home financing is actually a loan granted to shop for a piece of assets. To obtain the financing, you’re going to have to experience an application process. Your own borrowing from the bank was appeared, inspections should be performed with the possessions. Immediately following these items is complete, the vendor as well as the client head to an ending so you can sign the right transfer out-of control papers. this is complete through loan places North Johns a mortgage broker, and also the offer is sealed at the a name company.

Having your borrowing in a position for evaluation because of the a prospective loan facilities is paramount to obtaining the resource for your house. Unless you are alone wealthy you’ll you prefer the assist. There are some significant borrowing from the bank enterprises that offer you research. Constantly discover a tiny fee towards the statement if you don’t was indeed recently refused getting credit. you need a duplicate of your own statement it doesn’t matter because will say to you where you are to your a credit base.

Once you have obtained a duplicate of your report and now have deciphered they you next need to improve people discrepancies that seem. Should you get all of them fixed first, then chances are you need not get it done later on in the event that home loan organization desires an explanation. And they will. This is where you can very rating prior to the game. A little identified fact helps you away right here. You are allowed by Reasonable Credit scoring Operate to connect an announcement to your credit file. This will be up to 100 conditions and you can demonstrates to you most of the inaccuracies on your declaration. It generally does not reason all of them, however, teaches you all of them. Truth be told if you have one or two later repayments into the a charge card it does harm you from inside the acquiring the loan otherwise charge a fee so much more ultimately at closure. A conclusion that you were perhaps unemployed, or maybe just got trailing you will rescue the loan as well as the even more items you’ll have to pick.

Trying to find a real estate agent

There are various real estate professionals in just about any area, and that means you gets the option of exactly who to work alongside. Be sure to discover an individual who is reliable, sufficient reason for who you feel safe. As soon as your broker understands what type of assets you want to buy, she or he will start to make suggestions properties. You can find what things to remember, and you can concerns to inquire of, once you view property:

- What age is the furnace/air conditioning program? Air conditioners and you may furnaces are made to last ranging from 10 and you will two decades.

- What age is the rooftop?

- How old could be the equipment, and can it be staying in the home?

- Exactly what are the neighbors and the society such?

- In some functions, for example condominiums or townhouses, you’re going to have to pay good mainenance payment. What’s the price of repairs if it is provided? What does the constant maintenance shelter? Exactly what it always covers try turf restoration, h2o, sewer, use of common facilities, etcetera. This may are different very ensure after you ask it of just one seller your apply it across the board. Keep this in mind will never be rolled in the homeloan payment, it will always getting a different percentage you’re going to have to spend. Additionally, it may have a unique due date.

Delivering property inspector

The brand new evaluation is very important. It will determine items you didn’t possess understood out of in the past and you may alert you to help you possible problems subsequently. Brand new inspector are going to be registered in certain procedures eg plumbing and you will electricity together with building password inspection.

You can find a listing of inspectors on your local Purple Pages. Whatever they perform to possess a charge try examine this new devices, this new electrical integrity of the home. They’re going to and additionally scan this new rooftop, air conditioning units, and architectural activities. If they’re really squared away they’re going to also render along a termite inspector to seem to help you getting termites.

After all of the checks are carried out you’re provided a great report to deliver to the supplier and you may a fair number of day could well be set-up for the provider to fix new difficulties discover. Owner may well not trust your inspector’s really works. That is great, permit them to get their own yet , consider your because client have manage. If for example the provider will not consent or refuses to enhance the problems found, you’ve got an appropriate need to split the fresh new contract and you may forego the newest purchases.