Lara J. Cushing

step three Institution of Environmental Fitness Sciences, Fielding College off Public Health, College out of Ca, La, La, Ca U . s .

Abstract

Adopting the Great Despair and you may related property foreclosures, the us government mainly based brand new companies to facilitate entry to reasonable home mortgages, like the Family Owners’ Loan Agency (HOLC) and you will Federal Homes Government (FHA). HOLC and you can FHA led extensive society appraisals to decide capital risk, referred to as redlining, hence took into account residents’ race. great site Redlining and so lead to segregation, disinvestment, and you can racial inequities into the ventures to have homeownership and you may wealth accumulation. Latest browse examines connections anywhere between historic redlining and you may subsequent environment determinants away from health and wellness-related effects. Within scoping review, we assess the the quantity of latest looks off proof, the range of effects examined, and you can key research services, examining the assistance and electricity of your relationship ranging from redlining, community environments, and you may fitness together with different methodological steps. Complete, training nearly widely statement proof an association between redlining and you can health-relevant consequences, whether or not heterogeneity in investigation design precludes lead assessment out of efficiency. I vitally think proof out-of HOLC’s causality and gives an abstract structure towards relationship between redlining and provide-date fitness. In the end, i suggest secret tips for upcoming browse to improve and you will expand understanding of redlining’s long lasting impact and you may translate conclusions to the public health and planning habit.

Introduction

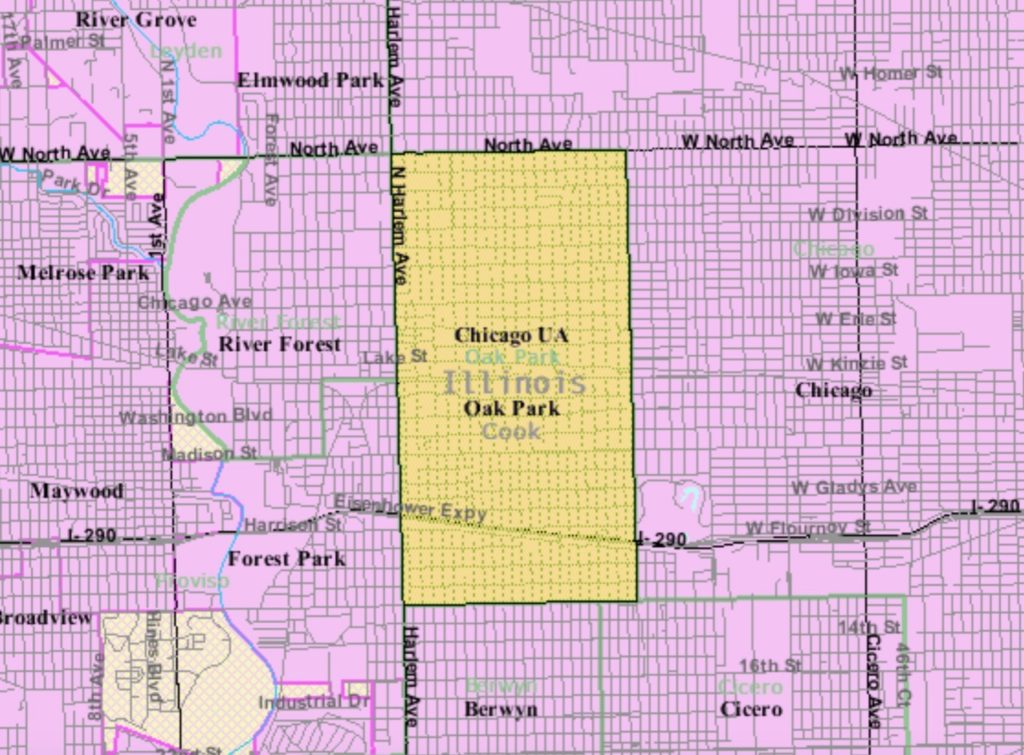

So you can balance out housing markets and you may homeownership adopting the Great Anxiety, government entities dependent the home Owners’ Loan Business (HOLC) – and therefore offered refinancing assistance to striving residents, to shop for its mortgage loans and you will reissuing amortized mortgage loans having longer fees timelines – as well as the Federal Property Government (FHA) – and therefore underwrote mortgage chance to increase banks’ spirits that have mortgage financing. In session which have local economic and a home informants, these types of firms used widespread society appraisals regarding money chance throughout the brand of color-coded home-based shelter charts (Fig. step 1 ) – normally ranking communities regarding A, best, to help you D, risky. The technique of ranking areas because the unsafe and you will borrowing from the bank-unworthy is referred to as redlining, adopting the color allotted to D amount neighborhoods throughout these charts [ step 1 5 ].

HOLC chart from Oakland, Ca. Authored by the fresh Mapping Inequality investment [ 7 ] less than an innovative Commons Attribution-NonCommercial-ShareAlike 4.0 International Licenses (

One of other variables, the fresh new assessments explicitly sensed neighborhood residents’ competition and you can ethnicity, into visibility of people out of color, immigrant, and/otherwise Jewish owners normally felt harmful. Specifically, little neighborhoods noted to include Black and you may Eastern Western or Filipino owners acquired A otherwise B reviews [ six , seven ]. Redlining deepened community racial domestic segregation [ dos , 8 ], and you may Black colored or other prospective homebuyers from colour was in fact disproportionately sealed out of advantageous financing words and you may new homes advancements – leading to a lot of time-term disinvestment within areas [ 1 , 9 ]. Previous look things to the fresh new hard work from present-big date economic disadvantage inside formerly redlined areas, plus high impoverishment, vacancy costs, danger of financing denials, subprime credit, and you can home loan default, minimizing monetary freedom, homeownership costs, and you can home prices [ 8 , ten 12 ]. not, another possible aftereffect of redlining – with the health – enjoys until recently started underexplored.

After the latest digitization from HOLC maps [ seven , thirteen ], an increasing number of education determine redlining’s association that have establish-big date environmental determinants out of health insurance and health consequences. Lee mais aussi al. checked several training off redlining and you will fitness inside a recently available logical remark [ 14 ], discovering that full redlining try for the a variety of unfavorable health effects. However, no remark provides but really included education toward dating anywhere between redlining and environment determinants off fitness.