Small Things

Since the just one mother, you may want to be eligible for $0 monthly obligations according to the current Rescue Plan, even if you possess Mother or father As well as fund.

The new forgiveness choices are from inside the advancement that could render rescue, particularly if you’ve been paying down loans for some time.

Review

Unmarried mothers, why don’t we begin by possible: There aren’t any specific student loan forgiveness applications otherwise has tailored for single moms and dads. But do not click away yet there can be still great news.

Even though it is not the newest instantaneous forgiveness you might expect, these alternatives been employed by for the majority of solitary mothers within the factors just such as for example your own. They’re able to promote genuine recovery and you can an obvious street forward.

Our objective is to support you in finding an informed method to manage your finance and secure a better financial upcoming for your requirements along with your youngsters. Why don’t we begin.

Save yourself Bundle Forgiveness

Brand new Save your self Package might possibly be your ticket so you can considerably down student mortgage repayments possibly even $0 30 days. When you find yourself juggling this link loan repayments which have child care will set you back, casing, and all additional expenditures regarding raising kids yourself, this plan was created to you planned.

What it is: New Rescue Package ‘s the newest and more than ample income-passionate repayment option available. Its designed to build your monthly premiums economical considering your revenue and you will relatives size.

Which qualifies: You happen to be qualified for those who have federal Lead Financing. This includes financing your got on your own education and you will Moms and dad Also funds for individuals who combine all of them (regarding it afterwards).

Down repayments: The program spends 225% of your own poverty line so you can determine discretionary earnings, meaning a lot more of your earnings is protected.

Interest work for: In case the payment will not safety accumulated appeal, government entities will cover the real difference, blocking your balance away from growing.

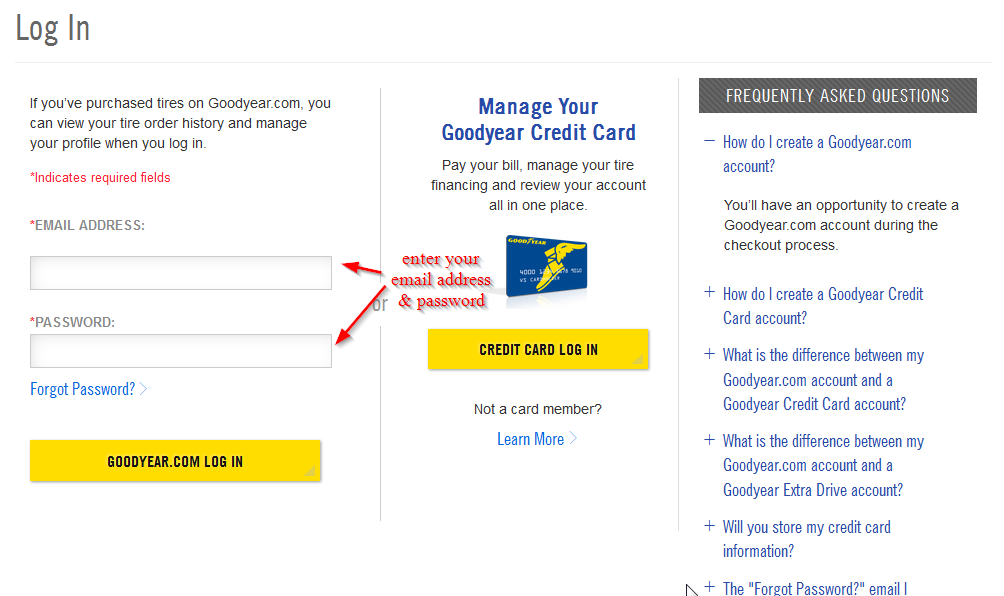

How exactly to pertain: You could potentially get new Cut Package during your financing servicer or at the . You will have to give facts about your earnings and you may loved ones proportions.

Note: Even though some areas of the Save Package are presently to the hold because of courtroom demands, the key positives, including the possibility $0 costs, are still readily available. This new U.S. Department regarding Training was attempting to pertain most positives, which could make this plan a lot more beneficial to have single mothers afterwards.

2nd procedures: Whenever you are enduring your existing costs, envision trying to get the Save Bundle immediately. It might somewhat decrease your month-to-month weight, providing you with alot more economic respiration room to care for your family.

Public service Loan Forgiveness

For those who performs full-going back to the us government or nonprofit team, you could have you government student loans forgiven shortly after ten years of developing education loan costs.

What it is: The latest PSLF Program forgives their leftover government student loan equilibrium once you create 120 qualifying monthly obligations (ten years) while working complete-going back to an eligible manager.

The brand new IDR Membership Modifications: If you consolidated before , you can find borrowing from the bank having early in the day symptoms out-of cost, even if you just weren’t with the a qualifying plan just before.

Second strategies: For individuals who are employed in public-service, cannot wait to start your own PSLF travels. Most of the being qualified percentage gets your nearer to forgiveness. In the event you are not sure you meet the requirements, it is really worth checking current changes made more single moms entitled to so it system.

Long-Name Forgiveness Choices for Unmarried Moms and dads

If you find yourself Help save and you will PSLF is preferred forgiveness selection, solitary mothers should also be aware of almost every other Earnings-Inspired Repayment (IDR) agreements that offer forgiveness once 20 so you’re able to twenty five years from money. This type of preparations will likely be crucial for those who try not to qualify for PSLF or are affected by the fresh Cut package keep.