Which have a variable-price financial (ARM), the interest rate alter sporadically. They are typically characterized by the time that have to pass until the rate is going to be changed (step 1, step 3, 5, 7 otherwise ten years, including). Cost are often below repaired-rate mortgage loans, however, hold the danger one a boost in interest levels tend to trigger high monthly payments.

FHA-Covered Funds

The fresh new Government Casing Management (FHA) even offers several reduced-down-fee financial affairs getting eligible people. For pointers and eligibility requirements, get hold of your bank otherwise see:hud.gov/fha.

VA-Guaranteed Loans

Whenever you are an experienced from armed forces service, reservist, otherwise to the effective armed forces obligation, you could be eligible for financing guarantee throughout the Department of Pros Situations. These financing has actually low down repayments.

Inspection reports

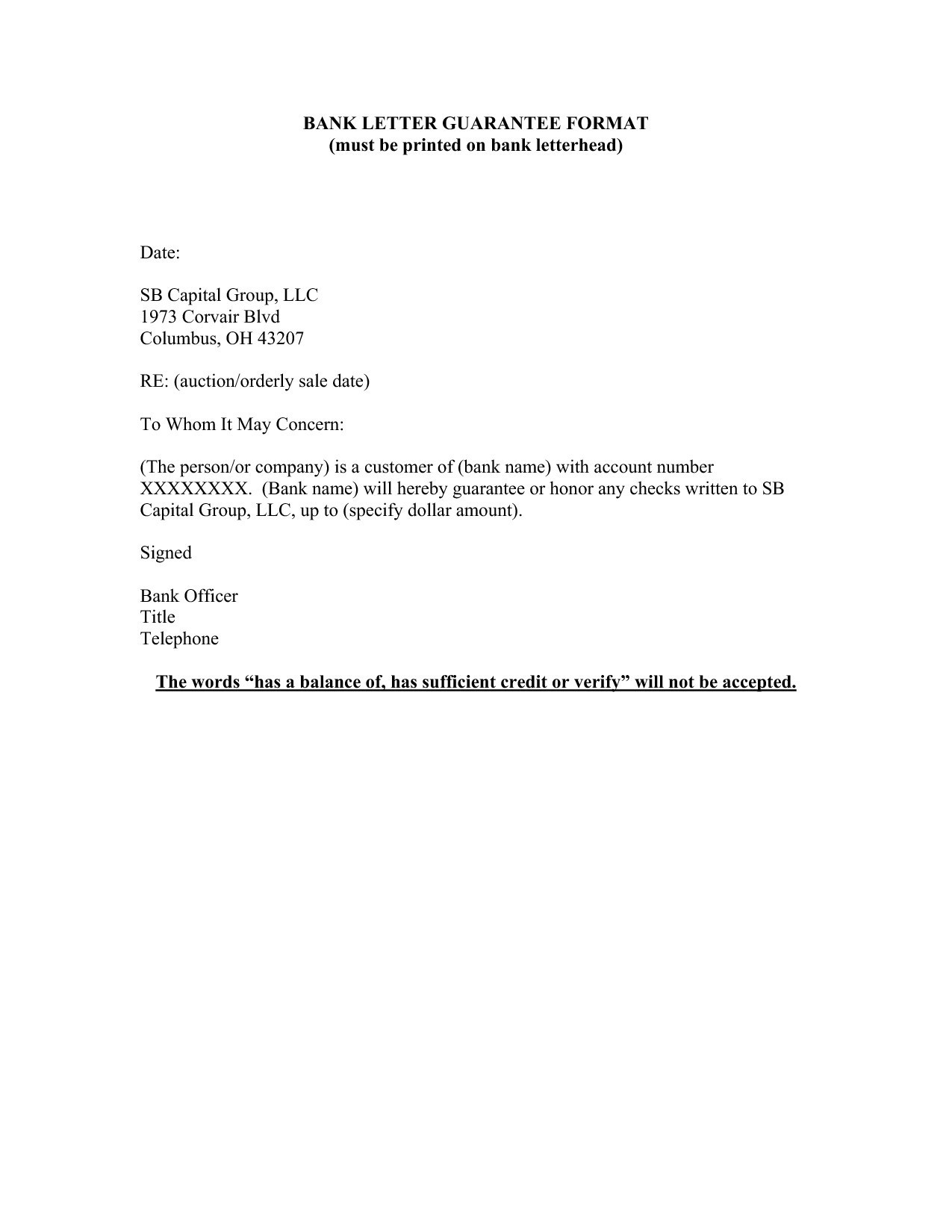

![]()

Lenders may require you have your prospective household checked because of the a specialist pop over to this web-site in advance of they approve your mortgage. Even though they don’t, hiring an inspector is an excellent cure for protect forget the. They may see structural, electronic otherwise plumbing system issues that you are going to change the conversion process price. But a thorough examination shall be beneficial in different ways. The past statement will likely be a formula getting something the consumer might be contemplating four or maybe more decades down the road, like establishing another roof, heating system otherwise hot water tank. Home inspections, which normally costs between $3 hundred and you can $600, can be let you know structural conditions that will get impact the price and you will their demand for your house. Home inspectors try registered because of the county.

Less than Wisconsin legislation, building inspectors was liable for damages that happen off a work otherwise omission in accordance with its examination. Likewise, he’s blocked out-of creating one solutions, restoration or developments into checked possessions for around two decades following evaluation keeps occurred.

For more information throughout the legislation or perhaps to check the reputation of an inspector’s license, excite name (608) 266-2112 otherwise lookup “inspection reports from the: dsps.wi.gov.

First-Date Home buyers

Purchasing your very first family might be problematic provided what plus the currency needed for a down-payment. Luckily, the state of Wisconsin has the benefit of educational and financial help from Wisconsin Housing and you can Monetary Innovation Company. For more information, visit: wheda/homeownership-and-renters/home-buyers

Preferred Financial Conditions

- Apr (Apr): Since it has things, expenditures and other can cost you recharged by the lender, here is the actual interest you will be investing. Since most of the lenders need certainly to compute this contour the same exact way, the latest Annual percentage rate will bring a opportinity for comparing financial proposals.

- Appraisal: An estimate of the property’s market price in line with the condition of one’s design, the worth of brand new property and also the attributes of one’s neighborhood. Appraisals are often necessary assuming a house is purchased, ended up selling or refinanced.

- Assumable Loan: A home loan that may be taken over of the client getting a charge. This type of mortgage loans end closing costs and you may mortgage charge.

- Settlement costs: Costs made towards closure date to fund attorneys charge, appraisals, credit history, escrow charges, prepaid service insurance premiums and other costs

- Popular Town Assessments: Labeled as citizen relationship charges, speaking of charges paid off of the tool residents to keep up the house or property.

- Advance payment: The amount of bucks paid of the homeowner at the time regarding closure. One deposit which is less than 20% of one’s price constantly needs home loan insurance coverage, hence increases the consumer’s monthly obligations.

- Escalator Condition: A provision enabling the financial institution to improve the eye cost and/or level of the loan in the event the industry conditions transform.

- Fixed-Speed Financial: A loan with a fixed interest you to stays constant more the life of your own loan.