Look at your Credit score

You will find around three fundamental credit bureaus. He or she is Equifax, TransUnion, and Experian. You can get a no cost credit history regarding all of them from year to year.

There are sites, for example Credit Karma, where you are able to availableness your credit report and you can see recommendations on boosting it. Because these are considered flaccid inspections, you won’t adversely impression your get.

You will be more likely to get a hold of changes in the rating in the event that your waiting a couple weeks to check on. This provides electric and you can credit card companies time and energy to upload profile or condition that may perception your get.

Don’t simply let a collection of expenses sit on your kitchen dining table. Make certain you try purchasing these completely from the brand new deadlines. Starting an on-line autopay could be your very best to make certain fast costs – and you can a better credit rating.

8. Do it to alter Your credit rating

Since your credit rating products into your loan updates, work to raise they. Do this throughout the days prior to a property search. Next, you could potentially enter a good lender’s work environment equipped with a better rating.

Look after Credit lines

Open another type of line of credit and keep maintaining current of those. Starting an alternative credit card offers one other way of making on-day repayments. By maintaining existing playing cards, you are able to present elderly lines of credit.

Even although you keeps a credit card you rarely play with, ensure that it stays discover. Maintaining established credit lines excellent to demonstrate that you’re in charge.

Keep your Borrowing Usage Reasonable

Credit use relates to just how much their charge card limits you purchase. If at all possible, you desire so it matter to-be lower – not as much as 31%. How you can do this isnt to expend much playing with their mastercard!

An average American enjoys over $7,951 when you look at the credit card debt. You could potentially set yourself right up having a much better credit rating because of the not purchasing to your own credit limit. As well, pay back your debt completely each month.

Raise up your Borrowing from the bank Constraints

Their bank card company is ready to increase credit maximum. This provides you with a higher roof to own using. This may appear to be an invitation to pay way more with your credit card but don’t do it.

Raising a borrowing limit can help your credit rating by keeping their expenses activities normal. In case the credit limit increases, their borrowing utilization goes off.

Suppose you’ve got a credit card with a threshold regarding $six,000, along with your equilibrium try $2,000. Meaning your own use rates is actually 33%. But if you raise the limit to help you $8,000, your utilization rate is only 25%.

9. See Your loan Choices

With respect to bringing that loan, your existing economic picture get dictate the type of mortgage your can get. But understanding the differences makes sense prior to heading towards the lenders.

Preciselywhat are Old-fashioned Financing?

Personal lenders ensure conventional finance. Usually, what’s needed to qualify for this type of financing try rigid. You will need a credit history of at least 620.

A lower life expectancy credit rating implies that you can even pay a top interest rate. However however can get a down payment as little as installment loans in California step 3%. This new catch is that you need to pay private financial insurance coverage when the you add off below 20%.

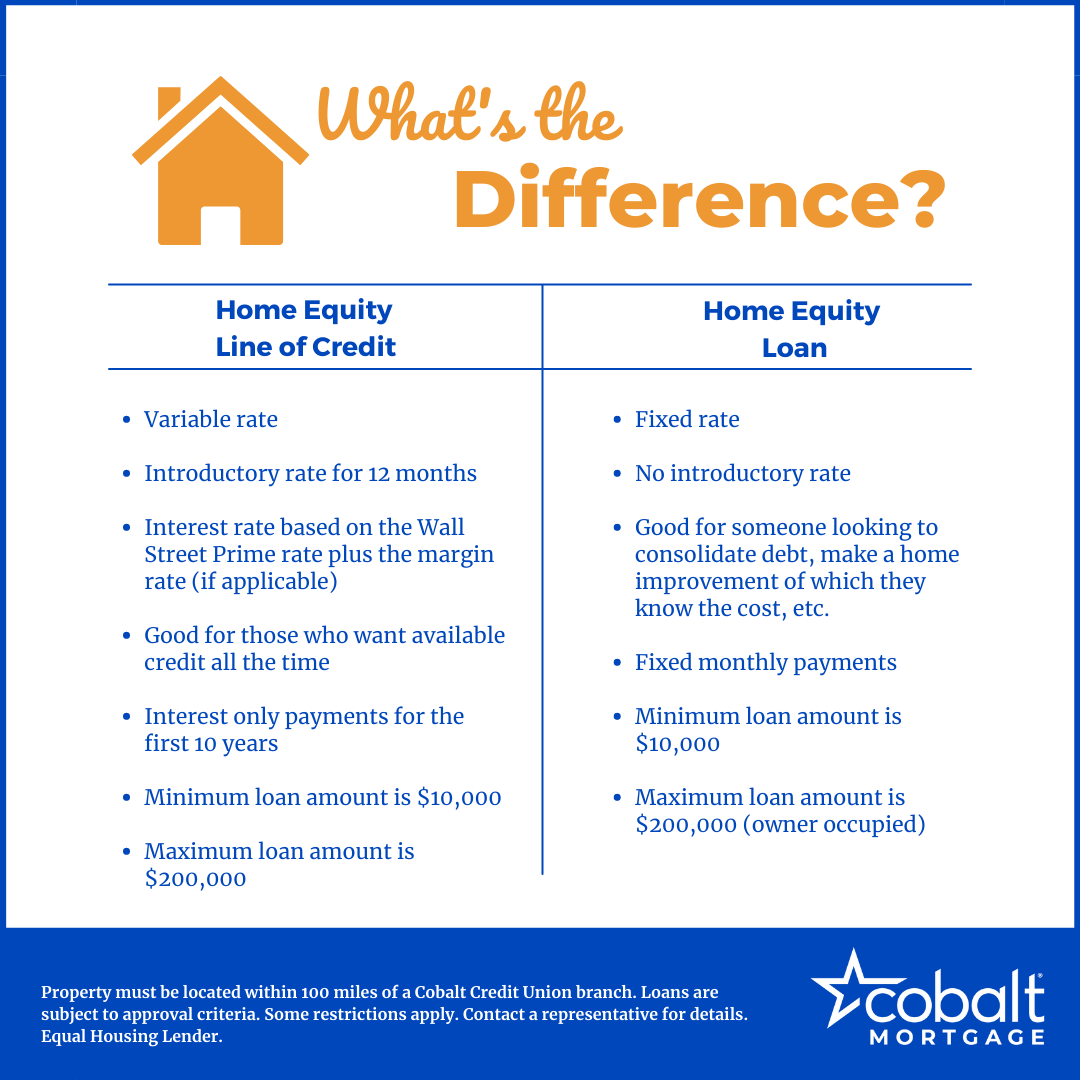

Fixed-Rate versus. Varying Price Mortgages

These are the one or two number one financial systems. Selecting the right you to definitely to meet your needs mode offered just how long you’ll be able to survive the house or property. You’ll want to consider interest style – and just how much bucks you have secured.