Try a credit rating out of 570 an excellent or crappy? Precisely what does a credit history from 570 imply?

We particular not so great news for your requirements. When you have a credit rating of 570, you have what exactly is noticed poor credit. As a general rule, fico scores less than 619 receive the worst interest rates into the home fund, auto loans and you will credit. The consequences can really take a cost for the somebody’s lifestyle therefore was tough than just you think.

Precisely what does having a credit rating regarding 570 imply to have home money, car and truck loans and you can handmade cards? How will you raise a great 570 credit score? Am i able to score a loan that have a credit rating away from 570? We shall address all those concerns and much more on this page.

Credit score out of 570: Auto loans

To purchase a vehicle which have a credit history off 570 is achievable, but you will be probably going to enjoys a very high attention price and certainly will you need borrowing resolve attributes. Those with less than perfect credit in the event the approved for a financial loan are always considering high interest rates than just somebody with a credit rating actually 80 items greater than its get. What’s the interest having a credit rating from 570 towards the a car loan?

The common amount borrowed by the automobile consumers is $27,000 based on Melinda Zabritski, Experian’s elderly director regarding motor vehicle borrowing from the bank. Once you factor in the 3 well-known variety of automotive loans for sale in myFICO’s financing deals calculator 36-month the fresh new car finance, 48-week the fresh auto loan and a 60-week new car finance you’ll get wise out-of simply how much more an automible loan will surely cost for an individual with a credit rating of 570 as opposed to a credit history regarding 650.

Therefore you might be advising me personally one to a keen 80 area difference in borrowing from the bank results contributes to a big change from $cuatro,443 for similar vehicle?

Sure, which is what our company is letting you know. Taking an auto loan that have a beneficial 570 credit history is going to help you charge you much more. To your an effective thirty-six month the fresh new auto loan, it’ll cost you $2,550 more. With the a beneficial forty eight few days, $step three,491 a lot more. For the a beneficial 60 few days car finance, it’ll cost you your an astonishing $cuatro,443 so much more.

Quite simply, should your obtained converted to a great 650 only an 80 section improve you’ll conserve several thousand dollars on your own financing. It is worth it to spend a family like Get in touch with Go Brush Credit to displace the credit prior to taking a road test.

Credit history of 570: Credit cards

What is the better bank card getting a get off 570? Unfortunately, whether your credit score was a beneficial 570, you will not qualify for an unsecured credit card.

People credit history above 600 may be eligible for an enthusiastic unsecured credit according to style of charge card you are making an application for. But if your credit score begins with a great 5 and results in two wide variety (70), then you’ll definitely just qualify for a protected bank card.

What is a protected bank card? It indicates your needed to build the absolute minimum put so you’re able to unlock your charge card. Wade Brush Borrowing from the bank constantly evaluates borrowing products and you may currently suggests such Shielded Cards if you have a credit rating from 570.

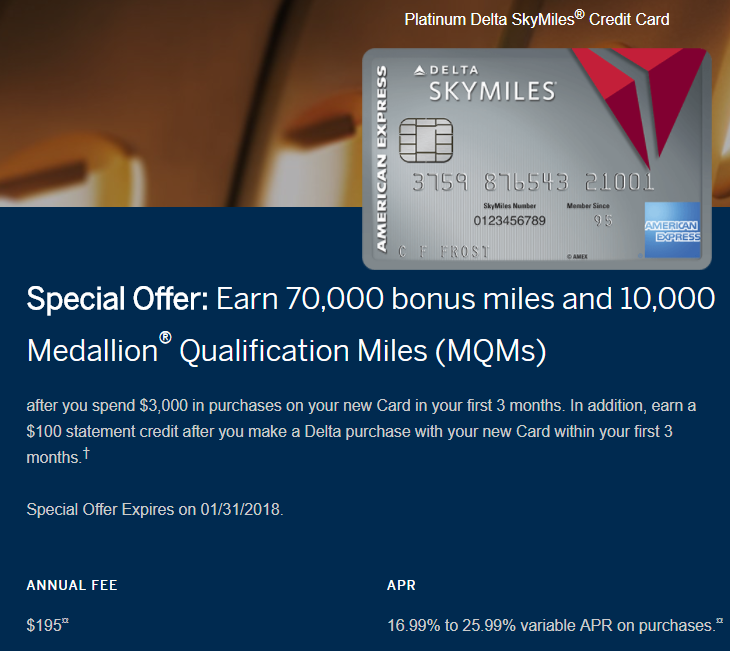

We come across to a great forty area rise in credit score by just beginning one of those cards. What the results are into the Apr having a credit score of 570? Let me reveal a map illustrating the differences between yearly charge and attract costs ranging from anyone having a good credit score and you may a credit score from 570.

Credit history out-of 570: Mortgage brokers

What if you are an initial time home consumer that have an effective credit score from 570. Is a credit history away from 570 purchase a property?

For some mortgages just be more than an excellent 620 credit get, however, there are numerous fund around which go down so you’re able to 570 to own FHA. However most other variables get harder (existence obligations in order to earnings) which causes it to be quite difficult to be considered less than 620.

Imagine if that you might be eligible for a great FHA mortgage which have a credit history out of 570. Given that you will notice from the maps less than, a minimal FICO score escalates the amount of cash might end up paying for a loan in the span of its life. Should your FICO rating try less than a good 560, extremely loan providers will not also consider providing you an effective jumbo mortgage for a great FICO rating you to reduced.

Note: The fresh 31-seasons repaired jumbo mortgage APR’s try projected according to the following the assumptions. Credit scores between 620 and you will 850 (five-hundred and 619) suppose a loan amount regarding $300,000, step one.0 (0.0) Affairs, just one Family unit members Owner Filled Property Particular and an enthusiastic 80% (60-80%) Loan-To-Well worth Proportion.

Getting home financing which have a credit score away from 570 can also add a supplementary $68,040 over the course of the loan than simply some body with a 721 credit rating. The speed for a credit score out of 570 increases the brand new monthly mortgage payment by $222 over people that have a rating 95 activities highest, at a credit score of 675.

Ideas on how to Increase A credit history regarding 570

Exactly how bad is actually a credit history from 570? As we’ve got present in the areas more than, which score impacts every facet of debt life. Mortgages, automobile financing and you can credit card rates of interest are common dramatically large than they’d become if you had average borrowing.

If you would like to evolve your credit rating away from 570, there are numerous methods do it.

1) Read through this blog post on precisely how to Improve your Credit history In a month. I record effortless tips contained in this article like paying rotating stability to help you less than 30% or other info that may improve your get quickly.

2) Check this out post about what To not ever carry out whenever repairing borrowing from the bank. The very last thing for you to do are disperse backwards within the your time and efforts to change the borrowing problem.

3) For individuals who surely have to improve your credit history within the 30 days, you’ll work with from the hiring the assistance of a credit fix providers such as for example Wade Brush Borrowing. To learn more about our very own credit resolve applications, delight call us.

Long lasting your situation, Go Clean Credit has a remedy. We have of a lot borrowing resolve programs available to simply help you overcome your own borrowing americash loans Naturita disease and place your right back to your road to financial achievement. Real borrowing restoration is not a good immediately following size matches all of the model therefore we modify your position off to the right program, but most anybody may start for only $99 monthly.

I’ve repaired rates software that get your straight back on course in as little as 5 weeks, debt resolution selection, software aimed toward people with got present short conversion or foreclosures and many more. Assistance is merely a free of charge call out you can also fill in an appointment consult. Get in touch with Go Brush Borrowing from the bank so you’re able to plan a free of charge appointment today.