Believe your perfect domestic. Now let us create a real possibility! Bluish Eagle Borrowing Partnership now offers flexible mortgage brokers to help with their homes requires. Whether you’re stepping into very first household otherwise need improve your latest place, you can find the loan you desire right here.

Tap into the residence’s equity to pay for high, initial and you will certain expenses. Such money, labeled as next mortgages (otherwise often the next home loan), is actually most useful once you already know just just how much you will need to spend given that you’ll get a lump sum simultaneously. Probably the most common spends away from repaired speed family collateral fund will be to combine loans, pay money for college tuition, crisis expenses such automobile fixes, or house resolve money to pay for a specific investment otherwise services. “, “button”: , “imageId”: “60d9eff8592c4d25f4e92b98”, “mediaFocalPoint”: , “imageAltText”: “Wrench and hammer icon”, “image”: , “colorData”: , “urlId”: “29obsbbeipvfa7iagymxrho1acqabe”, “title”: “”, “body”: null, “likeCount”: 0, “commentCount”: 0, “publicCommentCount”: 0, “commentState”: 2, “unsaved”: false, “author”: , “assetUrl”: “”, “contentType”: “image/jpeg”, “items”: [ ], “pushedServices”: , “pendingPushedServices”: , “originalSize”: “2350×450”, “recordTypeLabel”: “image” > >,

Make your home your favorite place to be. “, “spaceBelowSectionTitle”: , “sectionTitleAlignment”: “left”, “isSectionButtonEnabled”: false, “sectionButton”: , “sectionButtonSize”: “large”, “sectionButtonAlignment”: “left”, “spaceAboveSectionButton”: >” data-media-alignment=”left” data-title-alignment=”left” data-body-alignment=”left” data-button-alignment=”left” data-title-placement=”center” data-body-placement=”center” data-button-placement=”center” data-layout-width=”full” data-title-font-unit=”rem” data-description-font-unit=”rem” data-button-font-unit=”rem” data-space-between-rows=”60px” data-space-between-columns=”60px” data-vertical-padding-top-value=”3.3″ data-vertical-padding-bottom-value=”3.3″ data-vertical-padding-top-unit=”vmax” data-vertical-padding-bottom-unit=”vmax” >

Home Guarantee Repaired Rates

Tap into your home’s equity to pay for large, upfront and specific expenses. These loans, also known as second mortgages (or sometimes a second home loan), are ideal when you already know how much you’ll need to spend since you’ll receive a lump sum at once. Some of the most common uses of fixed rate home equity loans is to consolidate debt, pay for college tuition, emergency expenses like car repairs, or home repair loans to http://paydayloanalabama.com/albertville pay for a specific project or service.

Family Collateral Credit line

Get those individuals home improvement ideas moving which have property security range regarding borrowing (HELOC). A great HELOC can offer benefits and you can freedom by providing you availableness so you can mortgage money before you go to help you spruce up their place, buy holidays, wedding parties, and more. You can draw borrowing as you need as the initially loan closure is accomplished, it is therefore good financing alternatives whenever plans aren’t accomplished the at a time or if you you need periodic advances.

If you find yourself trying to refinance your current home, purchase your earliest family, improve to a much bigger house, or downsize now that the fresh kids have remaining this new nest, you can rely on we’ll support you in finding just the right home loan. Our very own apps can also be fit all the budgets, credit scores, and you may financing wide variety.

Make your home your favorite place to be. “, “spaceBelowSectionTitle”: , “sectionTitleAlignment”: “left”, “isSectionButtonEnabled”: false, “sectionButton”: , “sectionButtonSize”: “large”, “sectionButtonAlignment”: “left”, “spaceAboveSectionButton”: >” data-media-alignment=”left” data-title-alignment=”left” data-body-alignment=”left” data-button-alignment=”left” data-title-placement=”center” data-body-placement=”center” data-button-placement=”center” data-layout-width=”full” data-title-font-unit=”rem” data-description-font-unit=”rem” data-button-font-unit=”rem” data-space-between-rows=”60px” data-space-between-columns=”60px” data-vertical-padding-top-value=”3.3″ data-vertical-padding-bottom-value=”3.3″ data-vertical-padding-top-unit=”vmax” data-vertical-padding-bottom-unit=”vmax” >

Mortgages

When you are seeking refinance your current house, purchase your earliest domestic, enhance in order to more substantial home, or downsize now that the fresh new kids have remaining the fresh new nest, you can rely on we shall support you in finding best financial. The software is match all budgets, credit scores, and mortgage wide variety.

Belongings Financing

Did you select the perfect destination to homes and need a good land financing? It is rare to get a location financial institution prepared to do belongings fund, but Blue Eagle Credit Connection have the back! If you are having problems searching for your perfect home, and you are clearly looking to make, why don’t we chat! You can expect funds to have empty domestic lot requests and you can property to have recreational use.

Let’s rating one thing moving! When you need much easier home loan possibilities, aggressive rates and you can pro information, arrived at Blue Eagle Borrowing from the bank Union. I have vast amounts to give for your the latest or next domestic and you can worthwhile tips in order to find a very good service for the unique condition, whether you’re a primary-big date homebuyer or committing to even more features. There is in addition to partnered which have Representative Advantage Financial to make sure an entire list of mortgage situations in order to meet people requires. Undecided how to proceed? We can assistance with you to definitely, follow this link and you can let’s influence their homeownership specifications.

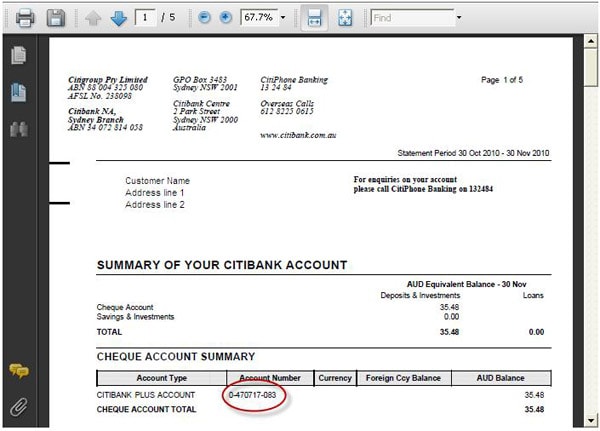

Collection Can cost you: You agree to pay-all costs off collecting the amount you are obligated to pay under it Arrangement, along with judge will set you back and you will realistic attorneys costs.

Late Charges: If for example the payment is more than fifteen those times owed your are required to blow a belated charge of five% of the commission count.

Annual percentage rate = APR1. The fresh Annual percentage rate received could be in the diversity uncovered significantly more than. The rate depends on each member’s creditworthiness, term of financing, and cost away from collateral offered than the quantity of mortgage. Delight ask for the rate you ple: $20,000 getting sixty days during the 5.75% Annual percentage rate = $ payment per month. Doesn’t come with loans cover. Used/New Bicycle Percentage Example: $fifteen,000 to own 60 months during the six.75% Annual percentage rate = $ payment. Does not include debt shelter. ple: $15,000 for 84 days within seven.25% Apr = $ monthly payment. Unsecured loan Payment Analogy: $seven,five hundred having forty eight weeks from the 9.00% Apr = $ payment per month. Does not include financial obligation coverage.2. Lowest Percentage: The fresh new payment on your own Overdraft Line of credit could be a beneficial at least $20 month-to-month.step three. Deals Secured: Bound Funds have to be in the a bluish Eagle Borrowing from the bank Union Discounts Account. Discounts Secured Commission Analogy: $5,000 for 3 years on 5.25% Annual percentage rate = $ monthly payment4. Apr is dependent on the top speed along with an effective margin and try subject to change monthly.5. Need to care for enough insurance. Minimal loan amount to own title out-of 96 months are $twenty five,000. Only a few candidates often be eligible for a reduced rates.6. Minimal amount borrowed to own HELOC and House Security was $10,000. HELOC enjoys draw age of twenty five years, percentage will be based upon fifteen 12 months believed label. Fixed The guy Percentage Analogy: $50,000 to possess 180 months in the six.00% ple: $25,000 to own 180 days at the 8.00% ple: $ in closing can cost you predicated on $25,000 loan amount.