Home collateral fund enables you to make use of your home security to get into earnings getting scientific issues, domestic home improvements, and you will anything you’ll need financing getting. For those who have high equity of your property, you really have possibilities with regards to applying for a loan.

A great Georgia house guarantee financing offers several benefits, and additionally competitive interest rates and much easier access to earnings. Learn how Griffin Money makes it possible to secure resource a variety of costs that have competitive domestic equity financing pricing when you look at the Georgia.

For those who have adequate security of your house, you should use that equity because the security to safe a house guarantee financing inside Georgia. That have an elementary house security financing, your essentially replace a few of the collateral of your house to own a lump sum of money, that can be used having any sort of you would like.

There are different varieties of family guarantee loans, therefore it is important to do your research before applying. There are even standards you should satisfy to apply for a great Georgia house collateral loan.

As a general rule, loan providers allows you to borrow to 95 % of one’s collateral you really have of your house – while some lenders may have an enthusiastic 80 percent restrict. You’ll get the loan in the a lump sum payment having a good repaired interest, which means you will have to generate monthly installments until the loan is actually repaid. You must and pay back your Georgia household equity loan prior to promoting your residence, otherwise your debt your debt would be removed from the newest deals continues.

You routinely have to incorporate W-2s and you will tax returns to apply for a home collateral financing, however you could probably submit an application for a no doctor domestic security mortgage courtesy Griffin Financial support when you’re thinking-operating.

Particular Household Collateral Loans

After you have decided good Georgia family security mortgage is good getting your, it is the right time to choose which sort of financing you want to take out. You really have two no. 1 choices: property guarantee financing otherwise property guarantee credit line (HELOC). Family security financing and you may HELOC rates money loans in Phil Campbell Alabama in Georgia can vary, which means that your decision have a tendency to affect your own payment per month.

Home security fund is repaired-speed fund that will be reduced for you in one lump sum. Just like the interest doesn’t alter, your own payment per month will continue to be a comparable up until your loan are paid. The length of a great Georgia domestic collateral mortgage is generally between four and 40 years, regardless of if mortgage attacks may differ.

Likewise, property security credit line offers a predetermined purchasing restrict according to research by the quantity of equity you really have on your own domestic. Home guarantee line of credit cost in Georgia are usually adjustable, which means your interest can go up or down mainly based on market conditions. Immediately following a blow ages of four otherwise a decade, pulls was restricted while the fees period starts on your HELOC.

There is no obvious-slash better home collateral loan , therefore it is vital that you determine your financial situation and pick a good financing that meets your finances and your needs.

Advantages and disadvantages out of Georgia Household Equity Fund

Household equity finance can be perplexing, which could make it difficult to decide in the event that a home security financing suits you. Understanding the software procedure and family security mortgage rates in the Georgia makes it possible to see whether a good Georgia household equity loan is actually to your advantage.

- Availableness competitive rates of interest.

- You don’t need to compromise their lowest-rates first-mortgage to try to get financing.

- Raise earnings.

- Possibly discount household security loan attention on the taxes.

- Utilize the dollars you receive to cover renovations, do-it-yourself programs, medical expenses, university fees costs, otherwise anything else you want.

- Accessing guarantee towards the first house, next home, otherwise capital functions.

- Household collateral financing can increase their full debt burden.

- Inability to repay a HELOAN may cause the increased loss of your home.

- Home guarantee loan costs and HELOC costs in the Georgia have a tendency to feel highest as compared to antique primary mortgages.

Finding out how family equity funds really works helps you make the correct choice considering your financial situation. When you have questions, you might call us before applying to own good Georgia home security mortgage.

Georgia House Equity Mortgage Certification Standards

One thing to bear in mind is the fact there are certain requirements you must satisfy to be eligible for property security financing. Check out of the criteria to remember ahead of obtaining a property collateral mortgage within the Georgia:

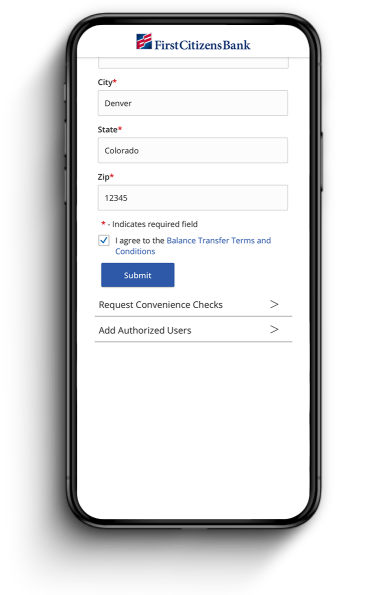

Existence near the top of your money was a button region away from qualifying to possess a home security mortgage during the Georgia. You need to use the latest Griffin Silver software to check on the borrowing get, monitor their residence’s worthy of, and you will discuss financial support possibilities. When you are having problems qualifying to possess house security finance within the Georgia, control your cash on the Griffin Silver application.

Apply for a property Guarantee Loan in Georgia

When you yourself have security of your property, you happen to be qualified to receive a beneficial Georgia household equity financing. Home guarantee loans are really easy to be eligible for for individuals who see certain requirements and competitive interest rates generate HELOANs an effective alternative should you want to combine debt away from unsecured loans and you will borrowing from the bank cards. But not, it is critical to determine the money you owe before you apply to own financing.

Isn’t it time to apply for a house equity financing otherwise house collateral line of credit for the Georgia? We are right here to aid. Incorporate on the web or get in touch with Griffin Financial support for additional information on exactly how you can get approved to own a property security financing and possess the money circulate you want to have disaster expenditures and family home improvements.