You simply cannot decide ranging from an unsecured loan, HELOC, or house equity financing? To determine and therefore financing is right for you top, glance at the distinctions at a glance:

Interest rates and you will Fees Conditions

For personal loans and you may house security money, repaired rates are prepared from the price conditions. Such rely on various circumstances for instance the credit history and you may loan amount. When it comes to a house guarantee mortgage, obviously, household collateral is another factor.

In contrast, the attention prices of your own HELOC is changeable. For the first mark period of a personal line of credit, you simply need to pay the eye toward amount you actually mark in the next phase of repayment months, the monthly payments of the dominant is actually additional. These payments as well as differ for the matter taken. not, because you do not make repayments in the 1st stage and only withdraw money, the pace to-be paid grows continuously. On the other hand, the fresh new monthly installments to your most other two money decrease steadily as the the principal is paid off.

Loan amount and you can Guarantee

Most of the around three fund are ways to get cash. While the home collateral loan and also the household security distinct credit portray a form of second financial and employ our home once the security, the level of the mortgage was directly linked to the house guarantee. That have an unsecured loan, concurrently, the maximum amount depends on multiple facts, and you will security is sometimes not required. On high type of consumer loan business, loans can be acquired away from $1,100 to over $100,100.

Loan Percentage

Towards the consumer loan, just as in our home collateral loan, the complete arranged count is actually relocated to your account following the offer try signed and you can a certain handling time. That range between several hours for some weeks, with respect to the lender.

This new HELOC, as well, is far more of an effective rotating financing that actually works such as a credit cards. More than a set time period, you might withdraw currency when you want to buy.

Annual percentage rate (APR)

Evaluating the 3 financing in the annual commission rates is much more tough. Private funds, the newest charge or other charges vary from completely free so you can most costly, with regards to the seller. For the other a couple of money, the closing costs or any other charge disagree simply minimally however, vary within team too.

Maximum Use and you will Tax Advantages

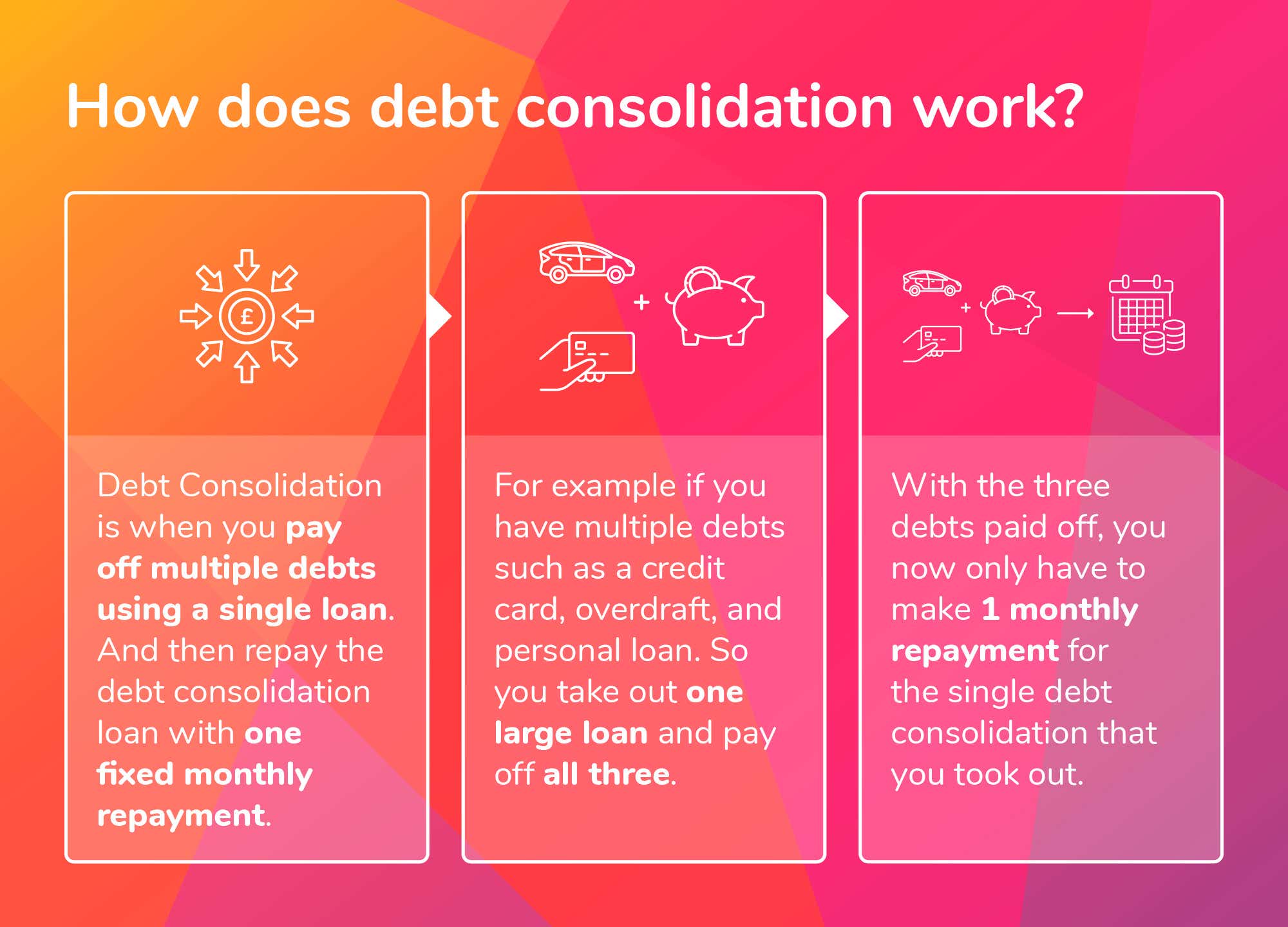

All the three fund aren’t fundamentally associated with objectives and certainly will feel invested freely read this article. The private financing are used for most of the biggest and you may slight purchases. If you find an exceptionally beneficial loan that have a low-rate of interest, you can even make use of it to settle a preexisting, more costly mortgage.

Likewise, a good HELOC and you can family security loan would be worthwhile. When you use this new fund to finance home improvements, your improve house equity of the home and can and deduct the interest to own tax aim. Of course, you could make use of the household equity loan getting loans fees or any other highest financial investments. The home guarantee range, additionally, is specially suitable for normal repayments eg medical expenses or university fees charge.

Exactly what If you?

Before you decide on a single of your around three loans, just be clear about what you would like precisely and exactly what requirements your fulfill. Would you like cash having a single-go out financial support and on a regular basis happening expenses?

Whatever you imagine: Better Egg is here now to simply help! Evaluate all of our Upright Money Chat area for additional info on household improvement money.