You may have viewed a pamphlet to have medical fund on the lobby dining table at the physician’s work environment otherwise dental care infirmary. These types of fund are widely used to money scientific expenditures. They often times features low interest and you may terms and conditions one to cause sensible payments. As well as, the program procedure is the identical for everybody, it doesn’t matter if you may have a handicap.

The newest connect is the fact extremely medical financing is actually deferred-notice fund. Otherwise pay-off the complete financing towards the end of marketing and advertising period, it will cost appeal from the start day of your own financing, for instance the bit you have got currently paid back.

For individuals who located federal disability benefits, you’re eligible for often Medicaid, Medicare, or one another. In some claims, you could consult coverage backdated to 3 months in advance of your own app to have exposure. These may be better options for you to definitely check out just before your make an application for a medical financing.

Car finance

A car loan try a secured loan using your car or truck since equity. For folks who default, the lending company takes aside the new guarantee.

You could sign up for a car loan during impairment instead jumping as a consequence of people unique hoops. Very car finance loan providers have at least credit history needs and you can only work at a credit check to see if your be considered. Particular also ensure your income.

Payday loans

Many people are not able to pay its payday loans entirely because of the deadline. Whenever that occurs, you will need to renew the loan and you may spend a whole lot more charges. Whenever you, it’s better to find options so you can cash advance in advance of catching what looks like a quick, effortless loan.

- Look at your borrowing: Make sure your credit report does not have any any problems which could connect with your capability in order to qualify for that loan.

- Require assist: Check with your regional Institution from Health and People Properties work environment to see if you are entitled to financial help.

- Lookup unique programs: Unique loan software may help someone on the a small fixed-income have the funding they want.

- Shop around to find the best cost: Take a look at rates which have multiple loan providers, specifically those who will do a mellow pull-on the credit if you https://paydayloansconnecticut.com/pawcatuck/ don’t are quite ready to pertain.

- Wait until you desire the borrowed funds: Prevent acquiring the loan too quickly, or you could threaten the disability income.

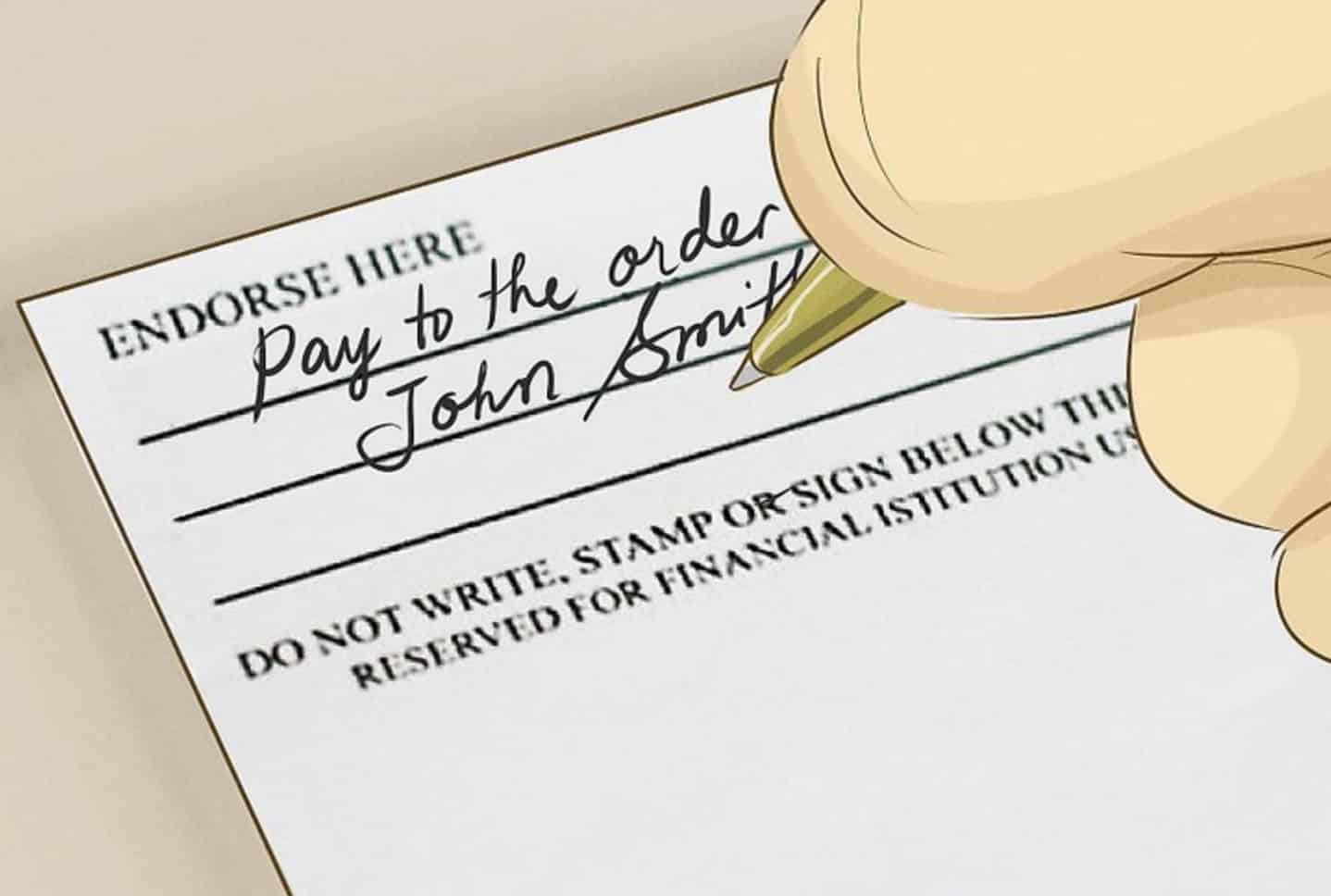

- Sign up for the loan: Your bank will say to you exactly what records add.

Like any major monetary choice, it is essential to consider the pros and you will cons off taking right out an unsecured loan, particularly if you’re on a predetermined earnings. Your best bet is to make sure to understand your options and you can very carefully come to a decision that works for you.

This new Ascent’s greatest signature loans

Shopping for a personal bank loan but do not see where to start? Our favorites give small recognition and you will rock-bottom rates of interest. Here are a few our very own listing for the best financing to you personally.

Sure. For people who be considered, you can purchase a consumer loan while on disability. Assume the lender to check on your own borrowing from the bank. You may have to keeps the very least credit rating otherwise an excellent maximum financial obligation-to-money ratio, along with your lender should probably select proof your own money.

More often than not, yes. Long-title handicap positives and you can permanent handicap insurance rates matter given that money to possess the reason for being qualified for a loan.

It’s a good idea to talk to loan providers and bodies businesses throughout the unique applications that might allow easier for you so you can get the economic demands came across. After you select the proper system, applying for that loan on impairment is not any distinct from implementing significantly less than other points. Before applying, ensure that your credit reports try mistake free, pay-all of your expense promptly, and you will reduce the other obligations to you can.