A fundamental piece of the newest purpose of one’s Government Homes Administration (FHA) should be to offer reasonable mortgages that both give brand new transition out-of renting to help you managing and construct sustainable homeownership. The latest FHA has not laid out just what it function by the sustainability. However, i arranged a good scorecard within the 2018 one songs the new a lot of time-term outcomes of FHA very first-time people (FTBs) and update they once again in this post. The details demonstrate that out of 2011 in order to 2016 approximately 21.8 per cent off FHA FTBs failed to endure its homeownership.

But not, about following 14 many years, the FHA never next articulated what it means by renewable homeownership, neither has actually it advised one metrics to have recording the advances up against so it important goal.

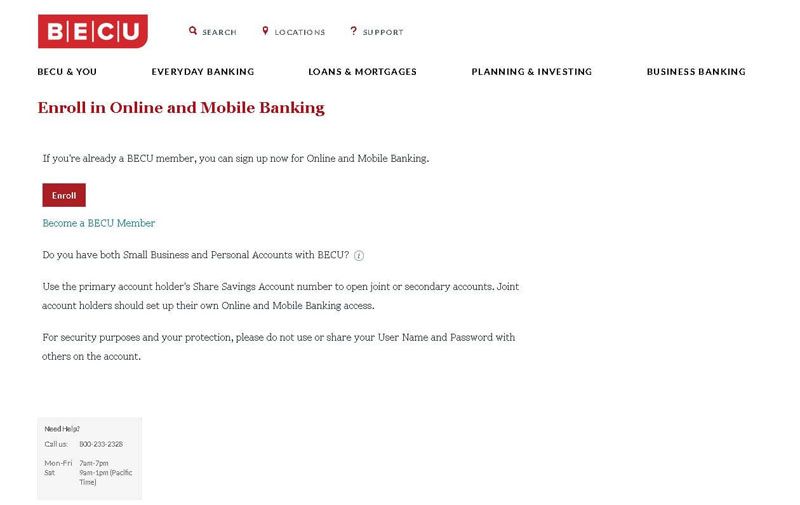

Sources: New york Fed Credit rating Committee/Equifax research; authors’ data

A significant purpose of the new FHA is to try to foster new transition out of domiciles off renting to help you buying. Merely up coming normally the family begin to build family guarantee. However, the best popularity of this domestic security accumulation is based vitally towards the new durability from homeownership.

The main focus of one’s FHA on changeover out of leasing so you’re able to owning is seen because of the its very high express out-of mortgages for family sales attending basic-day buyers. I make use of the Federal Set aside Lender of new York’s Credit Committee (CCP) study to understand a great FTB since the children taking up good financial if it have not previously got a home loan to the their credit file. Our earliest graph shows this new annual post on FHA buy mortgage loans ranging from FTBs and you can recite buyers.

Out-of 2000-twenty-two, 83 per cent off FHA pick mortgage loans went along to FTBs. This even compares to 62 per cent so you can FTBs towards Experts Things (VA), 56 percent to your regulators-sponsored entities (GSEs) Federal national mortgage association and you can Freddie Mac computer, and you can 57 percent for all someone else.

How comes with the FHA over during the targeting its borrowing promises so you can qualified consumers? Most FHA FTBs improve minimum step 3.5 % downpayment. That is, it begin its homeownership experience in very little domestic collateral (or equivalently very high control-an obligations so you can security ratio more 27). This example brings little support to soak up people family rates declines. The following important underwriting standards to possess pinpointing licensed individuals is actually their credit history.

During the early 2000s, the personal-title cover (PLS) industry lengthened and competed loans Frisco CO to have share of the market, reducing the FHA’s quantity of pick mortgages so you can FTBs. Taking a look at the graph a lot more than, we can note that the PLS field lured the new seemingly more powerful borrowing consumers away from the FHA. Out of 2001 so you’re able to 2008, 70 % regarding FHA FTBs got weak fico scores (that’s, fico scores below 680). Pursuing the financial crisis, the financing profile regarding FHA FTBs has enhanced. Yet not, due to the fact 2014 more than 1 / 2 of FHA FTBs continue to have credit scores less than 680.

Durability Scorecard

For the 2018, we suggested defining alternative homeownership since the a good FTB paying the FHA mortgage and purchasing a swap-up domestic (often that have a non-FHA mortgage otherwise a unique FHA mortgage) or as domestic continuous to invest off their modern FHA mortgage or refinancing in order to a non-FHA mortgage. It makes one or two situations in which the homeownership experience is not suffered: (1) the family non-payments to the the FHA financial, otherwise (2) the household takes care of the FHA home loan however, transitions returning to leasing for around 3 years.

There are 2 demands to using that it durability scorecard. Earliest, the new FHA keeps a streamline re-finance system which allows FHA borrowers so you can refinance regardless of if its current FHA financial was underwater-which is, the balance with the FHA financial is higher than the present day property value our house. Having fun with an improve re-finance allows the latest debtor to lessen their interest rate but doesn’t extinguish the new FHA’s borrowing from the bank contact with this new debtor. Instead, the credit coverage is actually directed in the purchase home loan for the refinance. As well, a debtor can improve re-finance more than once. Effectively gauge the default rates, we proceed with the debtor instead of the mortgage because of the linking any improve refinances toward original FTB pick financial. A standard toward a streamline re-finance try tasked back to the fresh unique get mortgage.

Another problem try determining cases where the newest borrower effectively will pay from the FHA mortgage however, transitions back into renting. We pick this type of instances because of the observing zero new mortgage borrowing from the bank once the fresh product sales of the property. I use the very least rental period of 36 months to stop instances when a family movements and you can rents to own a period of time when you are determining the best places to purchase the trade-upwards home.

Notes: The 5 types of consequences tend to be people that default on the FHA mortgage, people that pay back the modern family however, change to help you renting again, individuals who continue on the completely new FHA mortgage, people that flow whilst still being rely on a keen FHA-insured home loan, and people who re-finance otherwise move to a property which have a great non-FHA-covered home loan. Recent years are when the mortgages are began.

Durability refused even as we approached brand new economic crisis therefore the construction tits. Into the 2006, less than half out of FHA FTBs were able to endure homeownership. Thankfully that is actually the littlest cohort for the regards to total FHA FTB buy mortgages. Durability proceeded to alter immediately after 2006 and you will stabilized at around 70 percent this season. Regarding 2011 to help you 2016, FHA FTB sustainability stayed doing 75 per cent. Then monitoring of the data is necessary to make a company assessment of durability for recent cohorts ranging from 2017.

The improvement regarding the FHA FTB durability rate is actually due primarily in order to a towards 3.4 % within the 2016. Although not, the fresh express away from FHA FTBs transitioning back again to renting have stayed around 20 percent away from 2007 to help you 2016.

The newest revision toward scorecard means that the latest FHA increased the FTB sustainability pursuing the data recovery of casing in order to 2016, from the 21.8 percent regarding FHA FTBs did not sustain the initial homeownership and you can destroyed its opportunity to gather housing equity.

Donghoon Lee is actually an economic look advisor in the User Conclusion Studies about Federal Set aside Financial of new York’s Search and you may Analytics Class.