Brief understanding

- An effective 672 credit score is recognized as being good by VantageScore and you may FICO scoring patterns.

- With a good credit score, you may have a great deal more economic potential and stay accepted for much more good interest levels.

- You could potentially improve your 672 credit history having uniform, fit economic models.

Fico scores is an essential product regularly let have shown your own creditworthiness https://paydayloanalabama.com/red-level/. Let us understand exacltly what the 672 credit score form less than.

Skills and managing the credit

A credit score is actually a beneficial around three-finger amount you to stands for your creditworthiness. Its used, among additional factors, because of the lenders to assess the possibility of financing money to you personally, new borrower. A high credit history means a lower risk, that may make it easier to be eligible for financing and you may beneficial rates of interest. Credit ratings usually range from 3 hundred in order to 850, but according to the rating design used, the individuals numbers you will definitely belong to different credit reporting classes. Lower than, i break down the 2 head scoring activities and their particular credit score ranges.

- Excellent: 781 so you’re able to 850

- Good: 661 to help you 780

- Fair: 601 so you’re able to 660

- Poor: 500 so you’re able to 600

- Less than perfect: 3 hundred in order to 499

- Exceptional: 800+

Thinking about each other get models’ selections, a get out of 672 drops when you look at the good credit rating diversity. Although this often means that you could feel less risk so you’re able to loan providers in lieu of somebody that have a reasonable otherwise bad rating, it is critical to observe that some other lenders could have differing standards. At the same time, you will probably find one to an even higher rating you could end up straight down annual commission cost (APRs), highest borrowing from the bank restrictions plus.

Fico scores are affected by numerous items, also however limited to fee background, credit utilization and you may period of credit rating. Insights these types of factors makes it possible to make advised decisions to keep up and additional replace your get.

What an effective 672 credit score mode

Essentially, a credit history out-of 672 is recognized as being ideal for each other chief credit scoring activities (between 661 so you can 780 having VantageScore and you may 670-739 for FICO). It indicates your chances of to be able to purchase a house or take out an auto loan was more than people with a credit score in the a lower life expectancy range. In addition, you tends to be named a lesser exposure candidate to have that loan, and therefore you have created a specific number of credit rating and you will provides addressed your own credit smartly and be much more likely for much more advantageous conditions.

Purchasing a house with a great 672 credit score

Buying property which have an effective 672 credit history may be you can, nonetheless it tends to be harder than just should you have a keen sophisticated credit score.

All you pick, very carefully remark and examine various other lenders and you may loan options to look for your absolute best fit for your unique affairs. If you are crucial, credit ratings are only one of the points loan providers play with whenever giving home loans. Generally speaking, certain loan providers might require a more impressive deposit, charge high rates of interest or provides stricter financing words for home loan people they could consider in the an excellent assortment.

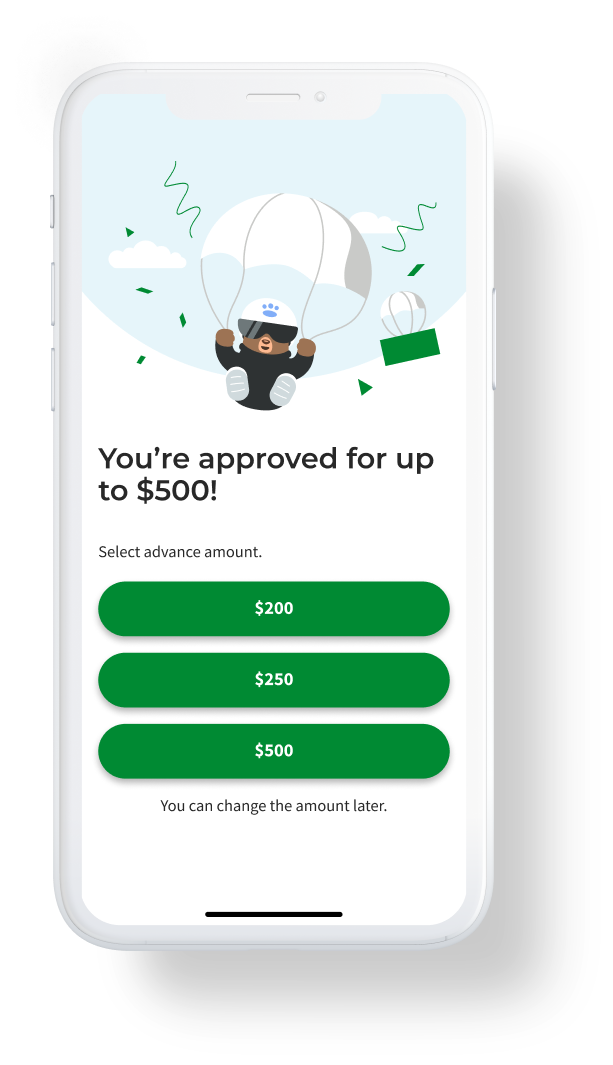

Acquiring almost every other personal lines of credit with a great 672 credit rating

That have a credit history out of 672, you happen to be recognized for different brand of borrowing, but the requirements and conditions you will are different according to the lender plus complete economic character. Fico scores are very important, however, there may be other factors to consider also, such as for instance:

Boosting your credit score increases the chances of getting an excellent credit line with additional positive terminology. Let’s mention some of the ways you can do this lower than.

Helping boost a great 672 credit history

Remember that aside from your goals, boosting a credit history will take time. You can view it fall and rise as you keep on your way to improving your creditworthiness. This can be normal. Are nevertheless patient and you will diligent on your approach to adding best practices getting monetary health since you continue to work towards the enhancing your score.

To conclude

Building a confident credit score does take time and you can compliment economic models. Whether you’re only starting out in your financial travels or enjoys viewed ebbs and you may streams on the rating, an excellent 672 credit score places throughout the a beneficial listing of the fresh Vantage and FICO activities. However, you could continue to assist in improving the rating and obtain way more positive loan terminology by the constantly applying match monetary activities.